Australian Super Indexed Diversified Review

Last Updated on 27 January 2024 by Ryan Oldnall

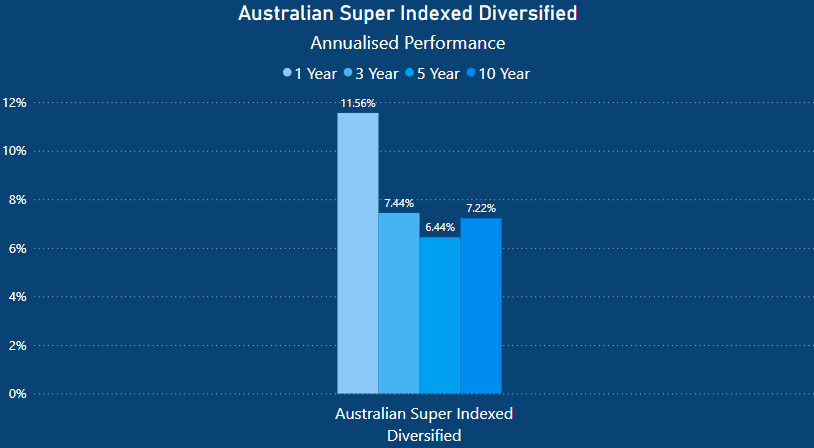

Australian Super has grown to become Australia’s largest super fund with 3.06 million members and $274 billion in assets under management (AUM) [1]. The Australian Super Indexed Diversified option has returned on average 7.22% over the past 10 years as of June 2023 [2].

In this Australian Super Indexed Diversified Review, we will delve into its performance, dissect its underlying strategies, and assess whether it might align with your financial objectives.

What is the Australian Super Indexed Diversified Fund?

The Australian Super Indexed Diversified is a type of investment option offered by Australian Super. The fund itself invests in a range of assets using indexing strategies.

The Australian Super Indexed Diversified Fund heavily invests in International Shares and Australian shares which have a current combined allocation of 70%.

What Are Indexing Strategies

Indexing involves adopting a passive investment approach in which a portfolio is built to replicate a market’s index performance.

This is frequently carried out using indexes such as the S&P 500 or ASX 200. Super Funds and investment funds alike will actively seek to mirror the performance of an underlying index.

This means they aim to replicate the performance of the overall market rather than actively selecting individual investments. A great example of this is Exchange-traded funds, more commonly referred to as ETFs.

To explore a more in-depth comparison of S&P 500 ETFs in the American stock market, be sure to read my article on IVV vs VGS article.

If you’re looking to gain insight into an Australian Share Market ETF, I recommend checking out my article A200 vs VAS

Generally speaking, Indexed Diversified Funds are investment options within superannuation funds that aim to diversify their investments across various asset classes, such as stocks and bonds.

Australian Super Indexed Diversified Fund Investment Strategy

Australian Super holds the distinction of being Australia’s largest superannuation fund, both in terms of size and membership base [1].

Super funds aim to effectively balance risk and returns through their underlying allocation strategies, categorized as either growth or defensive-focused allocations.

To maximise long term returns funds will allocate a higher percentage into growth assets such as shares. Whilst defensive allocations can be seen as cash, fixed interest, or bonds.

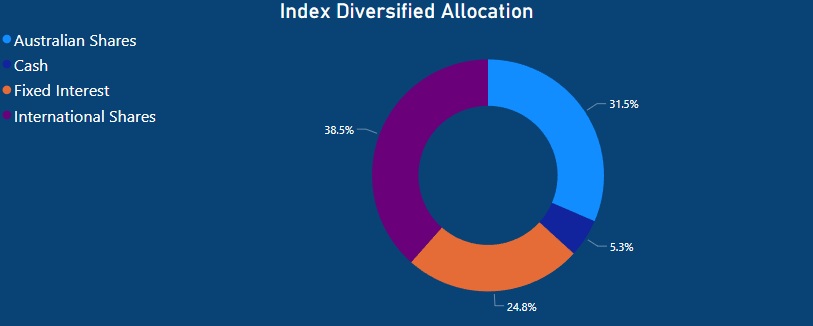

In the case of the Australian Super Indexed Diversified Fund, it allocates a significant portion of its portfolio across 4 asset classes.

As of 30 June 2023, Australian Super allocated 31.5% of their investments in Australian shares, 38.5% in international shares, 24.8% in fixed interest, and maintained 5.3% in cash or cash equivalents.

Diversification

One of the key principles underpinning Australia Super’s investment strategy is diversification.

By allocating their assets across different classes, such as Australian and international shares, fixed interest, and cash, the fund aims to spread risk and reduce the impact of under performing assets.

Diversification helps mitigate the inherent risks associated with each asset class, ensuring that the fund’s overall performance remains resilient in various market conditions.

This approach minimizes the potential for significant losses due to poor performance in any single asset category.

Role of Index Tracking

Index tracking plays a crucial role in Australia Super’s investment strategy, particularly in the equity portion of its portfolio.

Rather than actively selecting individual stocks, the fund opts to invest in index-tracking funds or exchange-traded funds (ETFs).

These passive investment vehicles are designed to replicate the performance of specific market indices, such as the S&P/ASX 200 for Australian shares or global indices like the MSCI World for international equities.

By doing so, Australia Super aims to capture broad market movements while minimizing the costs associated with active stock selection. This approach aligns with their goal of achieving consistent returns over the long term and is in line with their diversified investment strategy.

Australian Super Indexed Diversified Performance

When reviewing the Australian Super Indexed Diversified performance we can see very solid returns in its 1 year annualized returns.

As previously mentioned this data is as of 30 June 2023, with the International Share market having had solid growth in the past 12 months, particularly the S&P 500. The S&P 500 returned 16.34% in the same period according to Google Finance [3].

In comparison, the Australian Super Indexed Diversified option achieved a return of 11.56% during that year. This performance is attributed to its diversified allocation across various asset classes, rather than solely relying on just international shares.

Analyzing the extended-term performance of the Australian Super Indexed Diversified choice reveals a 7.44% yield over a three-year span, a 6.44% return over a five-year period, and a 7.22% return over a ten-year time horizon.

Australian Super Performance Comparison

Let’s compare Australian Super performance against their own available pre-mix options. If you are wanting to see how Australian Super compares to other funds, check out my Australian Super Review and Hostplus vs Australian Super, articles.

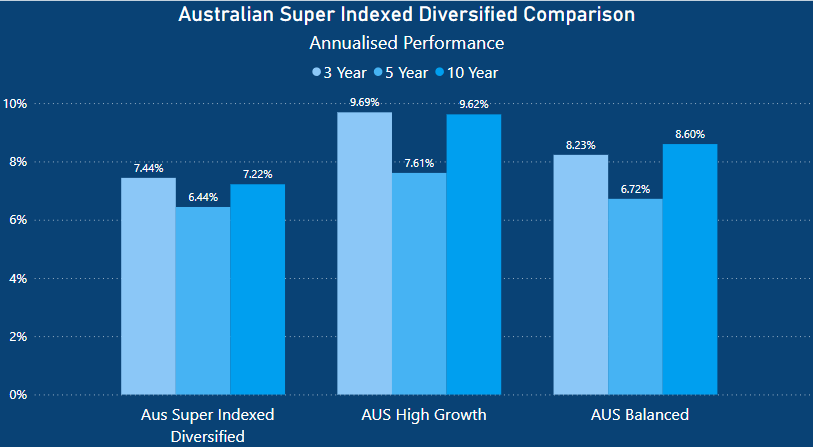

When comparing the different performances we can see that Australian Super’s high growth option is the clear winner over the short, medium, and longer term.

The contest for second place is slightly closer with the Australian Super Balanced option just edging out the Australian Super Indexed Diversified option.

Over a 3-year period, the Australian Super High Growth option delivered a return of 9.69%, significantly surpassing the return of 7.44% from the Australian Super Indexed Diversified option. The disparity between the two performances amounted to 2.25%.

When examining a 5-year time frame, the Australian Super High Growth Option generated a return of 7.61%, representing a 1.17% advantage over the 6.44% return of the Australian Super Indexed Diversified option.

Similarly, the Australian Super Balance option yielded a return of 6.72%, which still exceeded the return of the Australian Super Indexed Diversified option by 0.28%.

Over a 10-year horizon, the Australian Super High Growth option achieved a commendable return of 9.62%, surpassing the return of 7.22% from the Australian Super Indexed Diversified option by 2.4%.

Once again, the Australian Balance option outperformed the Australian Super Indexed Diversified option, boasting a return of 8.60%, a 1.38% advantage.

Australian Super Asset Allocation Comparison

To make better sense of this performance comparison we must also assess the underlying asset allocations between the different options.

Again, based upon the information available from Australian Super the information is as follows: [4].

The Australian Super Indexed Diversified Allocation

The Australian Super Indexed Diversified allocation has 4 components with Australian Shares being 31.5% and International Shares 38.5%. The total growth assets within the option is approximately 70% growth and 30% defensive.

The Australian Super High Growth Allocation

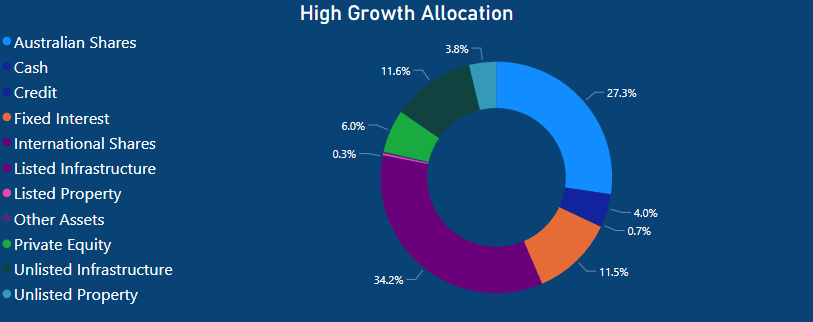

The Australian Super high growth option, on the other hand, consists of several components that make up the allocation.

The Australian Super High Growth option includes no fewer than 11 different choices, with Australian Shares making up 27.3% and international shares 34.2%.

Other significant allocations consist of 11.5% for fixed interests and 11.6% in Unlisted infrastructure. A greater proportion of the allocation is invested in growth assets when compared to the Australian Super Indexed Diversified option.

The High Growth option allocates 76.5% to growth assets and 23.5% to defensive assets.

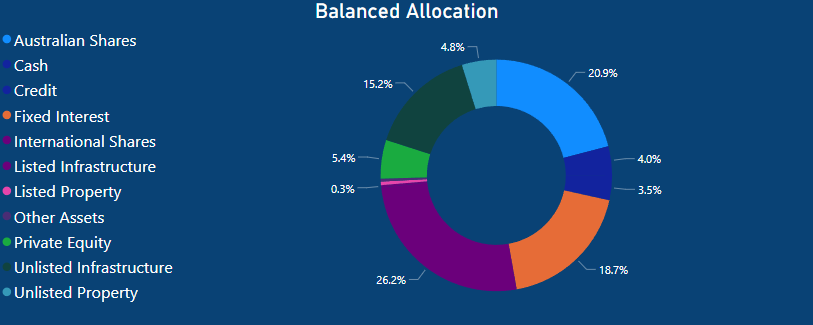

The Australian Super Balanced Allocation

Looking at the Australian Super Balanced allocation, it also comprises of 11 different allocations. However, it carries a lower overall weighting in shares compared to the high growth option, with 20.9% allocated to Australian Shares and 26.2% to international shares.

Other significant allocations in this category include 18.7% in fixed interest and 15.2% in unlisted infrastructure.

Consequently, the overall allocation breaks down to 65.5% for growth assets and 34.5% for defensive assets. This makes the overall allocation more defensive than that of the Diversified option.

Interestingly, the Australian Super Indexed Diversified option falls in between the high growth and balanced options in its allocation of growth and defensive assets.

Yet, the overall performance has been lower than the balanced option despite its higher growth focus.

Australian Super Indexed Diversified Fund Dollar Cost Comparison

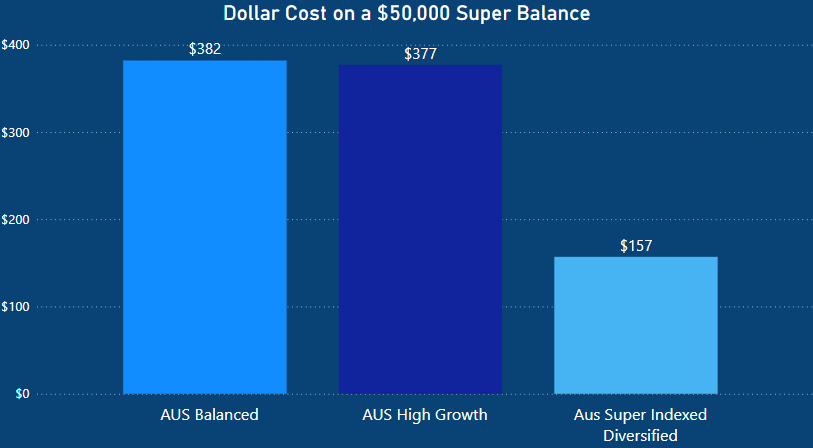

Lastly, an important consideration is the cost of the super fund option. As we have seen, the Australian Super High Growth option delivered the most superior results. However, that performance comes at a cost.

The Australian Super High Growth option costs $377 per year on a $50,000 balance. The Australian Super Indexed Diversified option costs a very low $157 per year on the same balance.

This option is nearly 2.5 times less expensive than the Australian Super High Growth option.

It’s important to recognize that although the Australian Super Indexed Diversified option at $157 represents a very affordable choice, the costs associated with the Balanced and High Growth options remain highly competitive.

This is something I review in detail in my Australian Super Review and Hostplus vs Australian Super, articles.

Summary

In summary, when choosing a superannuation option, it’s important to take various factors into account, including performance, fees, underlying asset allocations, as well as your individual circumstances like age, time to retirement, and financial objectives.

Therefore, it is wise to review your super fund investment choice holistically. The decision you ultimately make should align with your personal objectives and your overall risk appetite.

In the recent COVID-19 pandemic, individuals who opted for the high growth option would have faced more substantial losses compared to those in the balanced options. This is due to the increased exposure to growth such as the share market.

Overall, the Australian Super Indexed Diversified option is a very low fee, no frills and a robust selection with solid long term returns.

- https://www.australiansuper.com/campaigns/super-moments

- https://www.australiansuper.com/compare-us/our-performance

- https://www.google.com/finance/quote/.INX:INDEXSP?sa=X&ved=2ahUKEwiNvoaf_7-BAxVfSGwGHamDByUQ3ecFegQIJhAf&window=5Y

- ,https://www.australiansuper.com/investments/your-investment-options/pre-mixed-investment-choice