Buying Portfolio Diversification with Vanguard’s VGS ASX

Last Updated on 27 January 2024 by Ryan Oldnall

In today’s globalized world, diversification is a key aspect of any well-rounded investment strategy. The Vanguard MSCI Index International Shares ETF (VGS) provides investors with a convenient and cost-effective way to access a diverse range of international stocks.

Vanguard’s ETF, VGS tracks the MSCI World ex Australia Index providing exposure to companies from developed and emerging markets outside of Australia.

This blog post explores the benefits of a diversified ETF and delves into the Vanguard VGS ETF and the MSCI index, shedding light on why VGS can be a smart choice for investors seeking international exposure.

What is Vanguard MSCI Index International Shares ETF (VGS)?

VGS, the Vanguard MSCI Index International Shares ETF, is a widely recognized global exchange-traded fund (ETF) listed on the ASX (Australian Securities Exchange). It offers investors a diversified portfolio of internationally listed companies by closely tracking its benchmark.

Based on Vanguard’s latest fact sheet, VGS holds an extensive selection of 1,472 internationally listed companies. This broad coverage ensures that investors have exposure to a wide range of global market opportunities.

VGS aims to replicate its benchmark index, though has variations in some stock weightings, particularly in the US. Vanguard targets companies ranked within the top 85% by market capitalization, providing representation of leading global companies across various sectors.

A notable advantage of VGS is its low Investment Management Fee, set at an attractive rate of 0.18%. This cost-effective structure allows investors to participate in global market growth without incurring high management expenses.

While the VGS portfolio, like many global indexes, displays a significant bias towards the United States, this allocation reflects the concentration of large, influential companies listed in the US stock market.

Nevertheless, VGS maintains a commitment to diversification by including companies from other regions as well.

The Vanguard ETF performance record has been strong, with VGS consistently outperforming the category average in most years from 2012 to 2022. Although there were slight under performances of 1.1% in 2017 and 0.7% in 2020.

The Advantages of Vanguard’s VGS

One key benefit of investing in a diversified ETF such as VGS is the ability to spread risk across a wide range of international companies. Through investing in a wide range of global stocks, the risk is spread across various geographic locations and industries.

This risk mitigation is crucial for investors, as it ensures that returns are not solely dependent on the performance of a particular market, sector, or company. Diversification helps to lessen the negative effects of a market downturn and enhances overall resilience.

VGS provides exposure to companies in developed economies, including the United States, Japan, the United Kingdom, and Germany.

This broad exposure enables investors to take advantage of growth opportunities in these different regions, industries, and sectors. As a result, concentration risk is reduced, and the potential for long-term returns is increased.

MSCI World ex Australia Index and VGS ASX

The MSCI World ex Australia Index, which VGS tracks, serves as a widely recognized benchmark for evaluating international equity performance. This index comprises of both large and mid-cap stocks from 22 developed countries.

Australia is specifically excluded from this Index to allow Australians to gain exposure to international markets without potentially doubling up on domestically owned shares.

VGS closely follows the MSCI World ex Australia Index, resulting in a highly diversified and expansive portfolio comprising approximately 1,500 companies from various sectors and countries.

This level of exposure is remarkable and sets VGS apart from many other ETFs in terms of breadth and diversity.

What Are The Top Companies In VGS?

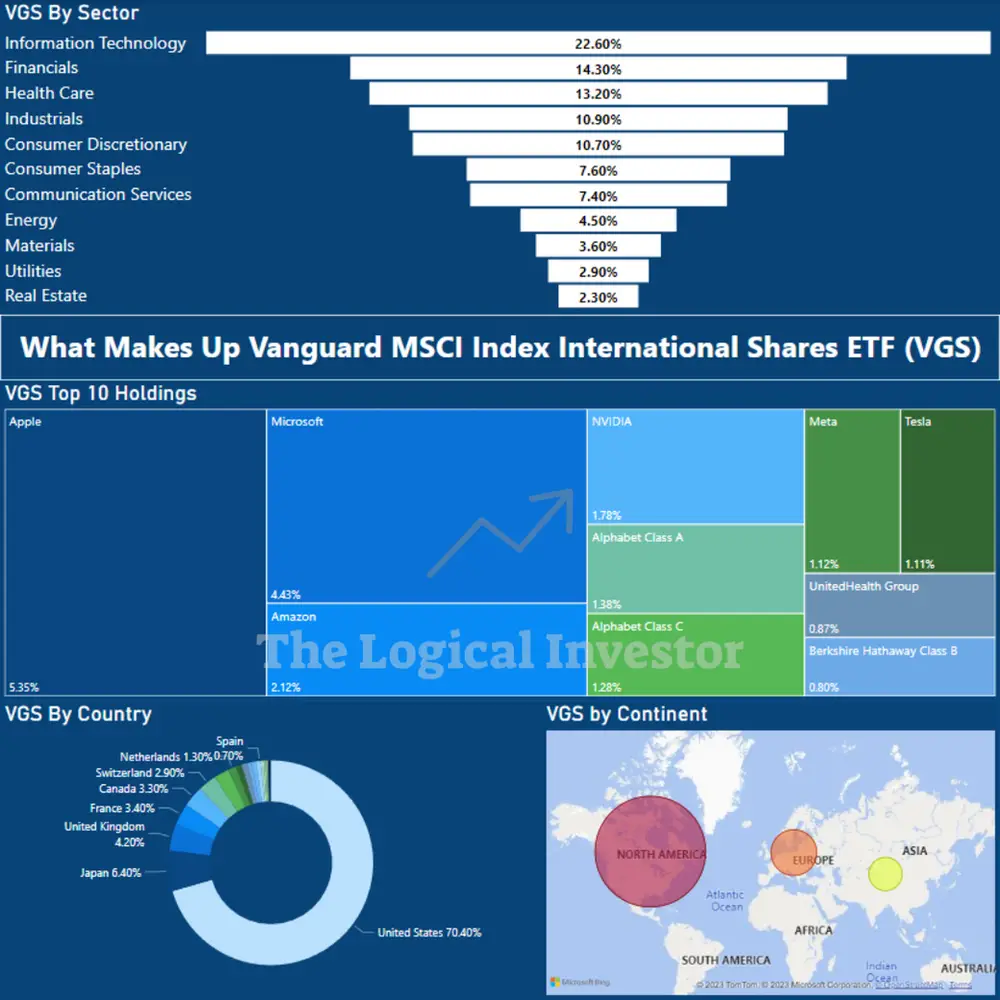

The top 10 company holdings in VGS represent 20.24% of its current portfolio, which increases to 20.9% when combining the allocation of Alphabet (Google) and including Exxon Mobil.

Like other international and US-based ETFs, companies such as Apple, Microsoft, and Amazon contribute to approximately 11.90% of VGS’s holdings.

What Does VGS Invest In By Sector

VGS invests in 11 sectors, with Information Technology holding the largest share at 22.6%. Additionally, VGS has significant investments in financials, health care, industrial, and consumer discretionary sectors, each accounting for approximately 10-15% of its allocation.

On the other hand, VGS has comparatively lower exposure to sectors such as energy, real estate, materials, and utilities, which together make up 13.3% of its total allocation.

What Does VGS Invest In By Country

VGS, the Vanguard MSCI Index International Shares ETF, has a notable emphasis on investments in the United States. This is primarily due to the fact that the US houses a significant number of the largest and most globally recognized companies.

Approximately 70.4% of the VGS allocation is dedicated to the United States. Following that, Japan holds the next substantial allocation at 6.4%. The remaining countries outside of the US and Japan have allocations of less than 5%. It’s important to note that VGS is designed to provide global exposure, but the US market holds a significant presence within its portfolio.

What Does VGS Invest In By Continent

VGS invests heavily in North America, Europe, and Asia. North America constitutes the largest share of VGS’ portfolio, accounting for 73.7% of its allocation. Europe follows with 18.4%, and Asia with 7.7%. VGS’ investments in other continents make up a combined total of 0.2%.

Can You Buy Portfolio Diversity With One ETF?

Portfolio diversity can be as simplistic or as complicated as an investor wants it to be. Many can argue just through purchasing a broad-based ETF such as VAS, IVV, or in this case, VGS would bring them diversity.

ETFs are an excellent vehicle for capturing a significant number of shares in one transaction. Their low investment fees and the reduced for brokerage transactions make them an attractive proposition for any investor.

Purchasing such a large global Vanguard ETF like VGS, containing over 1500 international companies certainly brings diversification. For Australians, it is important to note as mentioned this specifically excludes Australian domestic companies.

VGS has over 70% of its allocation in the US, so investors will need to be conscious of other international ETFs they may hold such as IVV.

Through owning both IVV and VGS an investor may create too much concentration in their portfolio on tech-based stocks. VGS and IVV are heavily represented in both ETFs so for some investors this may have too much exposure for their liking.

This article is for informational purposes only and does not constitute as an endorsement or recommendation to purchase any specific mentioned product.