Australian Super Review: Are They Still The Biggest and Best?

Last Updated on 27 January 2024 by Ryan Oldnall

Australian Super is Australia’s largest industry superannuation fund. Australian Super has grown to have over 3 million Super members and has an office in every major Australian city, as well as, London, Beijing and New York [1].

In this Australian Super Review, I will discuss the pros and cons of Australian Super and discuss why I decided to make the switch.

Who Are Australian Super?

Australian Super was Formed on 1 July, 2006 through the merging of Superannuation Trust of Australia (STA) and Australian Retirement Fund (ARF) [2].

Australian Super has continued to grow its membership base through several mergers since its formation. Australian Super’s latest merger was announced on 11 April 2022, merging with LUCRF.

According to the press release from Australian Super, it was stated that the merger would result in a combined inflow of over $10 billion in retirement savings, accompanied by the transfer of 180,000 members to Australian Super [3].

As a profit-for-member fund, Australian Super prioritizes the interests of its members and does not allocate profits or dividends to shareholders. This approach ensures that any profits generated are exclusively utilized for the benefit and welfare of its members.

Who Owns Australian Super?

Australian Super is a member-owned superannuation fund, which means it is owned collectively by its members.

The fund operates on a profit-for-member basis, and the interests of its members are prioritized in its governance and decision-making processes. There are no external shareholders or individuals who own Australian Super[2].

The Trustee’s shareholders, comprising of the Australian Council of Trade Unions (ACTU) through ACTU Super Shareholding Pty Ltd and the Australian Industry Group (Ai Group).

They have the authority to appoint the Member and Employer Directors responsible for Australian Super’s governance.

These Directors play a crucial role in representing the interests of the fund’s members [2].

How Big Is Australian Super?

As of December 31, 2022, Australian Super boasts a substantial membership base of 3.06 million members and manages member assets totaling $274 billion [2].

In terms of global ranking, it was found to be the 20th largest pension fund according to a worldwide study [4]. Australian Super has achieved growth by both attracting new members and consolidating its membership through mergers with other Super Funds.

Australian Super Is An Industry Super Fund

As an industry super fund, Australian Super does not distribute dividends or profits to shareholders. Instead, the money generated is reinvested back into the fund for the benefit of its members.

The fund’s primary focus is on delivering robust and sustainable long-term performance to enhance the welfare of its members, whom we consider to be the fund’s most valuable investment.

Due to its substantial size, Australian Super has the capacity to invest in both listed and unlisted assets.

Within its listed assets investment strategy, Australian Super allocates funds to Australian and international shares, encompassing exchanges such as the ASX.

Additionally, Australian Super has interests in unlisted assets, including infrastructure, property, private equity (investments in private companies), and private credit (loans for commercial real estate and infrastructure projects).

The fund’s infrastructure investments span various sectors such as transport, telecommunications, energy, and utilities.

Property investments encompass diverse real estate assets, such as residential, retail, industrial, and commercial properties.

Australian Super has made notable property investments, including the King’s Cross Estate in the UK and the Ala Moana Shopping Centre in Honolulu, USA.

In terms of infrastructure, the fund has invested in projects such as tolls WestConnex and Transurban Queensland Toll Roads, as well as a stake in Sydney Airport.

Australian Superannuation Review – Pre-Mixed Options

High Growth Option (76.9% Growth / 23.1% Defensive)

The high growth option is an investment that seeks to achieve strong long-term growth by diversifying its portfolio across a wide range of assets, with a particular focus on Australian and international shares.

As of March 31, 2023, the allocation of the fund was 27.5% in Australian shares and 34.2% in international shares. This allocation suggests a significant emphasis on international exposure, indicating a desire to benefit from global market opportunities in addition to the domestic market.

The fund aims to outperform the Consumer Price Index (CPI) by more than 4.5% per annum over the medium to longer term. However, due to the nature of high growth investments, there may be fluctuations in the short term.

Socially Aware Option (66.5% Growth / 33.5% Defensive)

The socially aware investment option applies exclusions based on environmental, social, and governance (ESG) screens to the Australian shares, international shares, and corporate securities component of the fixed interest asset class.

However, it also invests in other asset classes that are not subject to screening, such as private equity, unlisted and listed infrastructure, unlisted and listed property, credit, cash, and other assets.

The top portfolio allocations of the socially aware product consists of Australian shares at 21.5%, international shares at 25.9%, unlisted infrastructure at 15.1%, and fixed interest at 16.8%.

The primary objective of the socially aware product is to outperform the Consumer Price Index (CPI) by more than 4% per annum over the medium to longer term.

Additionally, it aims to surpass the performance of the median balanced fund over the same time frame.

While seeking medium- to long-term growth, the socially aware product acknowledges the possibility of short-term fluctuations. It combines a focus on responsible investing through ESG screens with the aim of achieving competitive financial returns.

Balanced Option (66.3% Growth / 33.7% Defensive)

The balanced investment option is designed to provide medium- to long-term growth while acknowledging the potential for short-term fluctuations.

It invests in a diverse range of assets, including shares, private equity, infrastructure, property, fixed interest, credit, and cash.

In terms of portfolio allocation, the balanced option has a composition very similar to the Socially Aware option, with the following top weights: Australian shares 21.2%, international shares 26.3%, unlisted infrastructure 15.2%, and fixed interest 16.9%.

The objective of the balanced option is to outperform the Consumer Price Index (CPI) by more than 4% per annum over the medium to longer term.

It also aims to surpass the performance of the median balanced fund over the same time frame.

It’s important to note that while the balanced investment option seeks growth, it acknowledges that short-term fluctuations can occur. Therefore, it is designed to provide stability and moderate risk while pursuing medium- to long-term growth.

Conservative Balanced Option (49.7% Growth / 50.3% Defensive)

The conservative balanced investment option is designed to provide medium-term growth while striking a balance between capital stability and capital growth.

Although it aims for growth, it also emphasizes a higher allocation to fixed interest and cash compared to the Balanced option, which contributes to a more conservative investment approach.

The top portfolio allocations of the conservative balanced option consists of Australian shares at 14.6%, international shares at 18.2%, unlisted infrastructure at 12.9%, fixed interest at 28.3%, and cash at 10.9%.

The objective of the conservative balanced option is to outperform the Consumer Price Index (CPI) by more than 2.5% per annum over the medium term. Additionally, it seeks to surpass the performance of the median conservative balanced fund over the same time frame.

While the conservative balanced option aims for growth, it recognizes the importance of capital stability and may experience some short-term fluctuations. The emphasis on fixed interest and cash helps provide stability to the portfolio.

Stable Option (31.8% Growth/ 68.2% Defensive)

The stable investment option places a strong emphasis on stability rather than growth, with a portfolio allocation that prioritizes fixed interest and cash.

The higher allocations of the stable option include unlisted infrastructure at 12.5%, fixed interest at 34.8%, and cash at 22.0%.

The primary objective of the stable option is to outperform the Consumer Price Index (CPI) by more than 1.5% per annum over the medium term. Additionally, it aims to surpass the performance of the median capital stable fund over the same time frame.

Given the higher allocation to fixed interest and cash, the stable option is designed to provide a higher level of capital stability, reducing exposure to potential fluctuations in the market.

This approach is suited for investors who prioritize wealth preservation and are more risk-averse.

Index Diversified Option (70.3% Growth / 29.7 Defensive)

The indexed diversified option is an investment strategy that utilizes indexing strategies to invest in a range of assets.

The top asset allocations of the indexed diversified option is as follows: Australian shares 28.0%, international shares 42.3%, fixed interest 24.7%, and cash 5.1%.

This option is designed to achieve medium- to long-term growth while acknowledging the possibility of short-term fluctuations.

The primary objective of the indexed diversified option is to achieve a return of CPI (Consumer Price Index) + 3% per annum over the medium to longer term.

By targeting a return above the inflation rate, the option aims to generate real positive returns for investors.

Indexing strategies typically involve tracking a specific market index, such as a stock market index or bond index, with the goal of replicating the performance of that index. This approach offers broad market exposure and can be cost-effective.

It’s important to note that while indexing strategies aim to match the performance of the selected index, there may still be slight variances due to factors such as tracking errors or management fees.

Australian Super Investment Options– Your DIY Mix

The Australian Super DIY Mix investment options provide investors with the flexibility to customize their asset allocations based on their preferences and investment goals.

These options typically include a range of asset classes for investors to choose from, including Australian shares, international shares, diversified fixed interest, and cash.

Investors have the freedom to determine their own asset allocation by selecting the desired weights for each asset class. This allows them to tailor their investment portfolio according to their risk tolerance, return objectives, and market outlook.

For example, an investor may choose to allocate a higher percentage of their portfolio to Australian shares if they have a positive outlook on the local market. They may also decide to allocate a portion of their portfolio to international shares to gain exposure to global market opportunities.

Additionally, investors can include diversified fixed interest and cash to provide stability and liquidity within their portfolio.

The Australian Super DIY Mix investment options empower investors to create a diversified portfolio that aligns with their investment preferences and goals.

It’s important for investors to carefully assess their risk appetite, conduct thorough research, and seek professional advice if needed when making asset allocation decisions.

Australian Super Vs Hostplus Super Vs Australian Retirement Trust

AustralianSuper, Hostplus, and Australian Retirement Trust have established performance records that can be compared.

All three Superannuation funds provide extensive historical performance data, and fee-related information. With this data, we can assess and compare their performances over the past decade.

This data has been sourced from the individual super fund’s website and is the listed performance up June 2023.

Australian Super Fund Performance Comparison

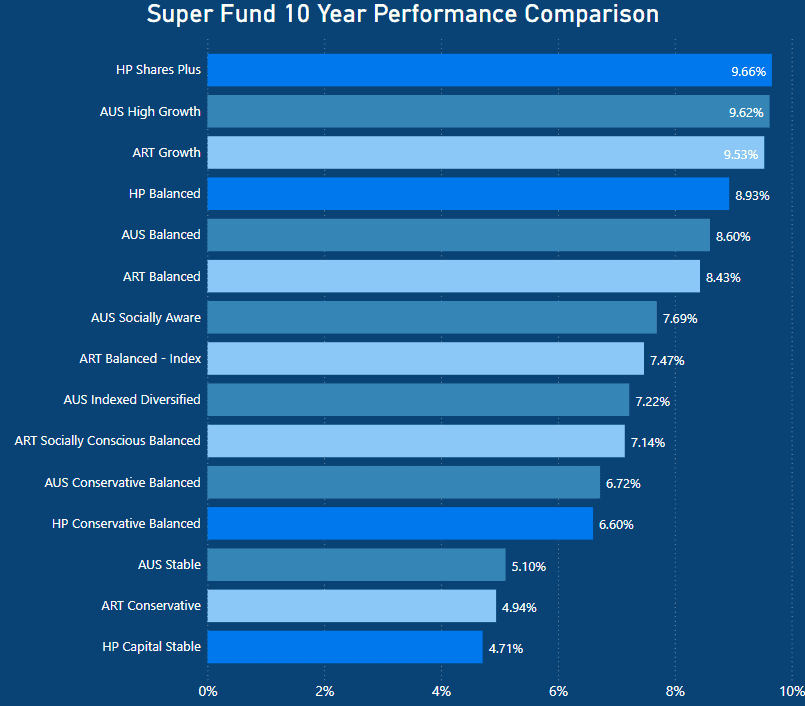

Australian Super vs Hostplus Super and Australian Super vs Australian Retirement Trust Performance Over 10 Years

When comparing the 10 year performances across the three Super Funds, Hostplus Shares Plus is the performer with a 9.66% return. This is marginally higher than that of AustralianSuper who returned 9.62% on their high growth option.

When looking at the performances more generally the funds are very similar in their performances across the relevant investment options.

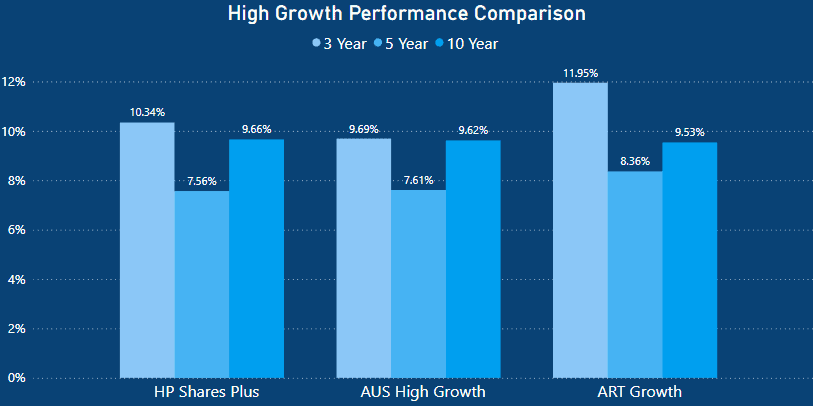

AustralianSuper High Growth Option Comparison

When evaluating the short-term performance of the Australian Supers high growth option vs Hostplus and Australian Retirement Trust. You can see that Retirement Trust’s growth option significantly outperformed Australian Super and Hostplus over the 3 and 5 year period.

ART returned a staggering 11.95% over 3 years, which was 1.99% more than Australian Super and 1.61% more than Hostplus. When looking at the longer term time frame of 10 years, Hostplus emerges as the eventual winner.

Hostplus returned 9.66% on their high growth option surpassing Australian Supers performance of 9.62%. Australian Retirement Trust returned 9.53% over the same period, 0.13% less than that of Hostplus.

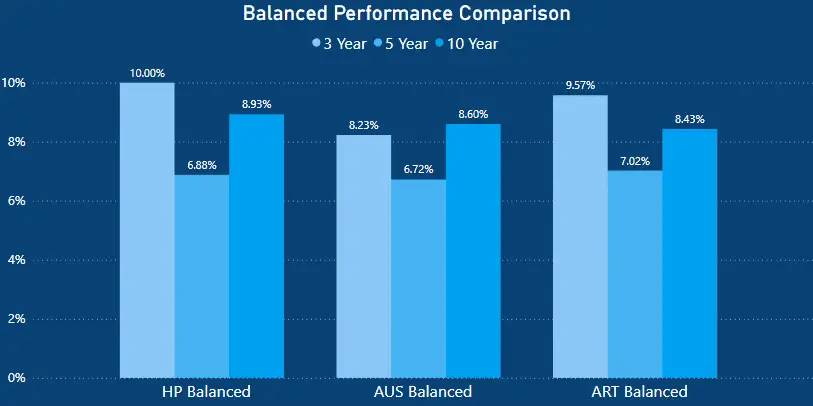

Australian Super Balanced Growth Option Comparison

When assessing the balanced performance Hostplus and Australian Retirement Trust were the clear winners over the short term. Hostplus returned a flat 10.00% whilst Australian Retirement Trust produced 9.57%. Australian Super lagged behind with a 8.23% return over 3 years on their balanced growth option.

Over 5 years the performance was closer between the three funds with Australian Retirement Trust having the best performance with 7.02%, this was 0.30% better than Australian Super who managed 6.72%. Likewise, Hostplus also outperformed Australian Super by .016% with their 6.88% return which was still less than that of Australian Retirement Trust.

Similar, to the High Growth option, Hostplus had the best 10 year performance on their balanced option returning 8.93%. AustralianSuper was second with 8.60% and Australian Retirement Trust returning 0.50% less than Hostplus with 8.43% performance.

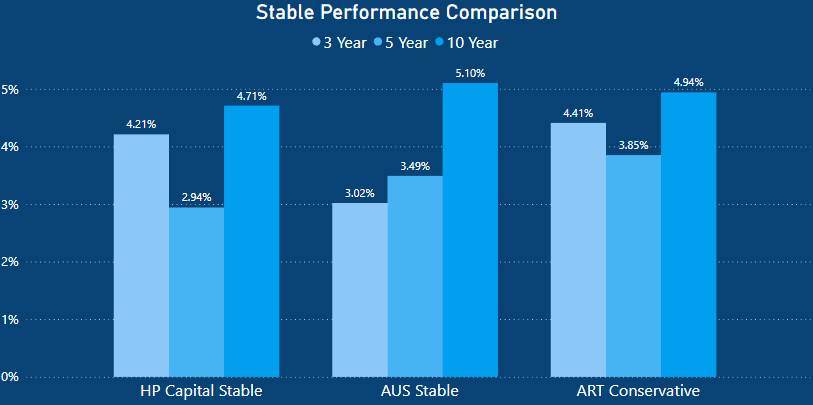

Australian Super Capital Stable Option Comparison

When comparing the stable vs conservative performances of the three funds, Australian Retirement Trust and Hostplus have the closest 3 year performance returning 4.41% and 4.21% respectively. Australian Super returned 3.02% on their stable option over the 3 years.

When assessing the 5 year period, Australian Retirement Trust returned 3.85% which was greater than Australian Supers 3.49% and much better than Hostplus who dropped off to 2.94% over the 5 years.

Over the longer term time frame of 10 years, Australian Super emerges as the winner with a return of 5.10%. This is 0.16% better than Australian Retirement Trust’s return of 4.94% and 0.39% better than Hostplus who managed 4.41%

Brief Explanation of Super Fees

Administration Fees

Super funds charge administration fees to cover the overall expenses involved in managing your super account. These fees include costs like operating the fund’s call center and providing annual statements.

Administration fees can be structured as a fixed amount, a percentage of your account balance, or a combination of both. Many super funds set a limit, or cap, on the maximum total administration fees that can be charged in a year.

Investment Fees

Investment fees and costs (excluding performance fees) include direct and indirect expenses.

These expenses consist of internal investment management costs, fees paid to third-party investment managers, custody costs, derivative costs, and audit and administrative expenses related to holding and managing investments.

They contribute to the overall expenses associated with investment activities.

Transaction Fees

Transaction costs are additional expenses incurred by members who invest in a specific investment option.

These costs include various expenses related to the purchase or sale of the underlying investments, such as brokerage costs, settlement and clearing costs, stamp duty on investment transactions and due diligence costs.

Transaction costs for an investment option also include expenses associated with individual members’ contributions, withdrawals, and switches between investment options.

The calculation of transaction costs is typically based on estimated expenses for a specific period, such as the year ending on June 30, 2023. These costs are expressed as a ratio relative to the average value of all the assets in the investment option during that period.

It’s important to understand that transaction costs can vary and are subject to change from year to year.

Performance Fees

Performance fees are an extra expense that goes beyond the previously mentioned investment fees and costs, as well as any administration fees.

In Australian Super’s Product Disclosure Statement (PDS), they discuss that Australian Super does not directly charge a performance fee, but certain third-party investment managers may receive performance fees for achieving returns that surpass a benchmark.

Typically, these fees are calculated as a percentage of the investment returns that exceed a predetermined level of return. In many cases, there is an upper limit, or cap, on the percentage of investment returns that can be charged as a performance fee.

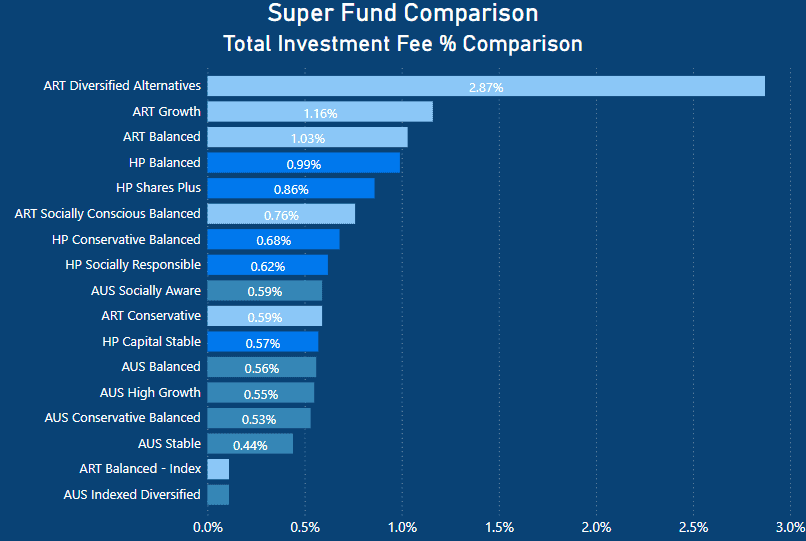

Australian Super Fee Comparison: Investment Related Fee %

When examining investment-related fees, it becomes evident that the fee amounts charged vary significantly based on the specific super fund product.

Australian Retirement Trust’s Diversified Alternatives option stands out as a clear loser on the investment side, with a substantial fee of 2.87% being charged! Both Hostplus and Australian Retirement Trust have higher investment related fees than that of AustralianSuper.

Australian Retirement Trust charge 1.16% on their Growth option, whilst Hostplus charges 0.86% on their Shares Plus. In comparison Australian Super charges a low 0.56% on their high growth.

For their indexed option, both AustralianSuper and Australian Retirement Trust charge a fee of 0.11% which is the lowest of the comparable options.

In general, when comparing the investment-related fees of the three funds, AustralianSuper is the lowest.

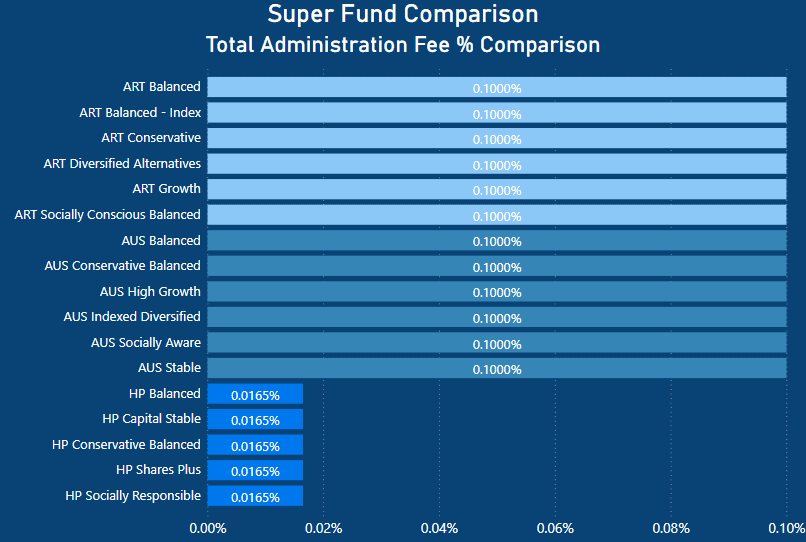

AustralianSuper Fee Comparison: Administration Related Fee %

Both AustralianSuper and Australian Retirement Trust charge 0.10% for administration-related fees whilst Hostplus charges the lowest with 0.0165%.

It is important to note that all three Super Funds charge additional fees on top of their administration fee. In addition to this fee, all three super funds charge an additional fixed dollar amount per week.

Australian Super charges a weekly fee of $1.00, whereas Australian Retirement Trust charges $1.20 per week.

Hostplus charges $1.50 per week on top of their 0.0165%. In the last financial year, in addition to the above listed costs, Hostplus deducted a further $32.91 per member from the fund’s administration reserve.

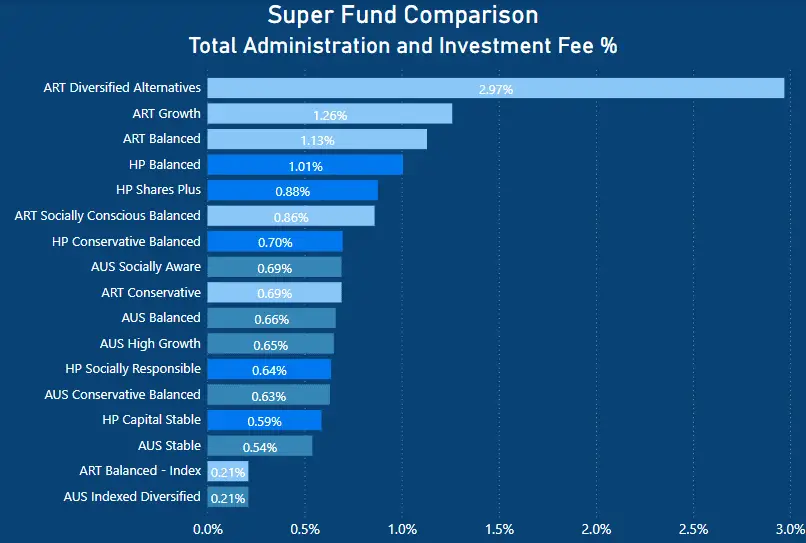

Australian Super Fee Comparison: Total Fee %

When examining the total fees charged, it comes as no surprise that Australian Retirement Trust’s diversified alternatives option is the most expensive, with a staggering fee of 2.97%!

When comparing the three funds across their offerings, Australian Retirement Trusts growth option charges 1.26%. This is considerably more than Hostplus’ Shares Plus 0.88% fee.

However, when compared to Australian Super’s high growth total fee percentage, both Hostplus and ART are more expensive.

Australian Super charges 0.65% for their high growth option. This is 0.61% cheaper than Australian Retirement Trust and 0.23% less than Hostplus’ equivalent option.

Again, when looking at the balanced option a similar story plays out. Australian Super leads the way with overall better total fee percentages.

Australian Super charges 0.66% on their balance option which is considerably better than Australian Retirement Trust. Australian Retirement Trust charges 1.13% which is 0.47% more than AustralianSuper.

Similarly, Hostplus charge 0.88% which is 0.22% more than that of Australian Super on their balanced option.

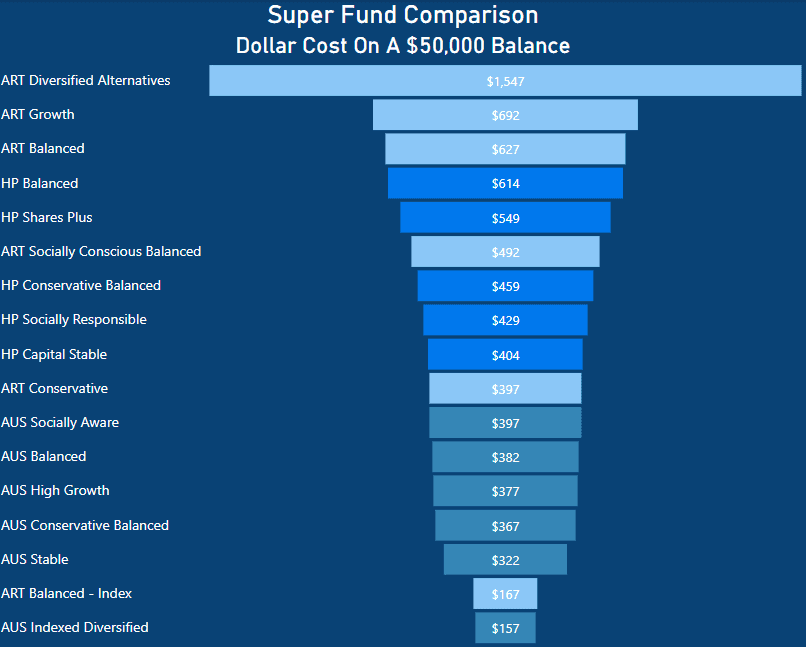

Fee Comparison: On a $50,000 Super Balance

When examining the overall cost of each super fund option, it becomes apparent that Australian Retirement Trust’s Diversified Alternatives option is the most expensive, costing $1,547 for a $50,000 balance!

Australian Retirement Trust growth option was the second overall most expensive product costing $692. Hostplus was not far behind with a cost of $549.

Australian Super’s high growth option was the cheapest costing a low $377. The difference between Australian Retirement Trust and Australian Super was $172.

When comparing the balanced options, Australian Retirement Trust was again the highest for fees, charging $627.

Hostplus’ balanced option came in a very close second charging $614. Both of these options are noticeably more than Australian Supers cost of $382. This means that both Australian Retirement Trust and Hostplus Super were $232+ more than Australian Super.

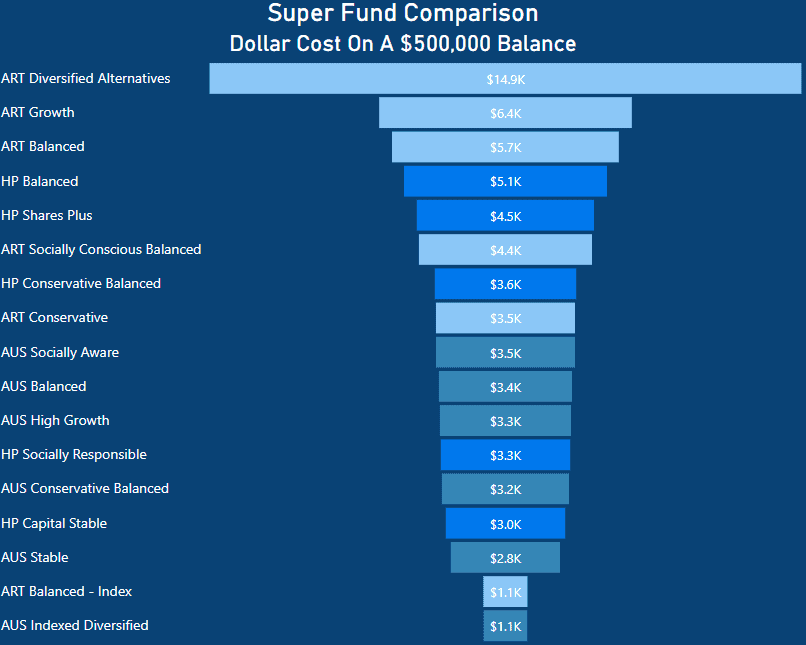

Fee Comparison: On a $500,000 Super Balance

When extrapolating this data to a $500,000 balance, the differences in fees become even more pronounced.

Australian Retirement Trust’s growth option charges an annual fee of $6,400 on a half a million dollar super balance. This is $1900 more than Hostplus who would charge $4,500 on the same balance.

As expected, Australian Super comes in at the best price of $3,300. This is over $3,000 less than that of Australian Retirement Trust and $1,500 better than Hostplus. This saving represents as a significant annual saving over the lifetime of a person’s lifetime.

Similarly, Australian Retirement Trust balanced option costs $5,700 and Hostplus costing $5,100. Australian Super’s balanced option was much cheaper with a $3,400 annual cost.

Again the difference in cost is substantial, with both Hostplus and Australian Retirement Trust charging $1700+ more than Australian Super for the same balanced option.

While fees certainly play a crucial role in the selection of a super fund, it is important to consider all the elements discussed in this review. Moreover, seeking financial advice where appropriate is highly recommended to make well-informed decisions.

Australian Super Insurance

Australian Super Fund offers insurance options within their products

There are three types of insurance cover available through Australian Super:

- Total & Permanent Disablement (TPD): TPD Cover is for the unfortunate event of a permanent disability that leaves you unable to work, TPD Cover provides a lump sum payment. It’s important to note that TPD Cover requires having Death Cover as well, and the TPD amount cannot exceed the Death Cover amount

- Death Cover: Death Cover ensures that if you become terminally ill or pass away, either you or your nominated beneficiaries will receive a lump sum payment.

- Income Protection: Income Protection provides regular payments to replace a portion of your income if you are unable to work due to illness or injury. Income Protection aims to maintain financial stability in certain times.

Should You Switch to AustralianSuper

When considering a switch in super funds, it is crucial to approach the decision thoughtfully and ensure that your reasoning and rationale are well-founded.

In my research of this topic, I have written an article about the process of choosing a super fund.

Australian Super stands out from its peers due to its low fees and impressive track record of historical performance. The company has consistently delivered positive outcomes and continues to attract substantial inflows to its super fund.

If you are contemplating a switch, it is crucial to evaluate the following factors when considering the possibility of changing super funds:

Performance: Evaluate the investment performance of the super funds you are considering. Analyze their historical returns and compare them to industry benchmarks.

Remember that past performance is not indicative of future results, but it can provide insights into how the fund has performed under different market conditions.

Fees and charges: Assess the fees and charges associated with each super fund. This includes administration fees, investment management fees, and other costs.

Lower fees can have a significant impact on your long-term returns, so it’s important to understand the fee structure of the fund you are considering.

Australian Super offers highly competitive fees, which can potentially contribute to higher overall returns for investors in the long run.

Investment options: Consider the range of investment options available within each super fund. Look for funds that provide a diverse array of investment options that align with your risk tolerance and investment goals.

Some funds may offer various asset classes, but it’s worth noting that Australian Super has the potential to invest in large unlisted assets, which may not be as cost-effective or viable for smaller super funds due to their illiquidity.

Australian Super offers pre-mixed diversified portfolios, which provide a simplified approach to investing. Moreover, Australian Super provides the flexibility for investors to build their own portfolios based on their preferences and risk appetite.

These options cater to a wide range of investment needs and present opportunities for diversification and customization.

Insurance options: Verify if the super fund offers insurance coverage, including life insurance, total and permanent disability (TPD) insurance, and income protection insurance.

Assess the cost and extent of coverage provided by these insurance options to determine if they align with your needs.

Additional features and benefits: Explore any supplementary features and benefits provided by the super funds. This may encompass online account management tools, educational resources, financial planning services, and member discounts.

Evaluate which features hold value for you and are in line with your financial objectives.

Fund stability and reputation: Conduct research on the stability and reputation of the super funds under consideration. Examine their track record, financial strength, and member satisfaction ratings.

Factors such as the fund’s size, longevity, and ability to consistently deliver returns over time should be taken into account.

Australian Super enjoys a notably large membership base of over 3 million members and manages funds totaling $274 billion as of December 31, 2022. Therefore, the fund currently demonstrates strong stability and reputation.

Exit fees and insurance implications: Before switching super funds, understand any exit fees or penalties associated with leaving your current fund.

Additionally, consider the impact on your insurance coverage during the transition period. Most insurance policies have a waiting period before coverage becomes active

It is advisable to review the product disclosure statement (PDS) provided by the superannuation providers to gather specific information about insurance coverage and waiting periods.

By being aware of any exit fees or penalties and understanding the insurance implications, you can effectively evaluate the potential costs and consequences associated with switching super funds.

Switching To Australian Super

In my article on How To Choose A Super Fund, I provide insights into my decision to switch from Aware Super to Australian Super.

One of the most noticeable differences I encountered was the stark contrast in fees. In my Aware Super Review, it was seen that Aware charged significantly higher fees. Furthermore, as mentioned in this article, Australian Super’s access to unlisted asset classes on a large scale made it an appealing choice.

Given my current investments in mutual funds, ETFs, shares, and residential property, Australian Super adds an additional layers of diversification potential, coupled with their low fees.

In my Vanguard Super review, I acknowledged their strong performance since their launch and their lower fees compared to Australian Super.

While I was initially tempted by Vanguard, I ultimately decided to go with Australian Super. However, it will be interesting to observe Vanguard’s performance over time and what areas they too may diversify into.

Summary: Australian Super Performance

Australian Super is the clear winner when it comes to fees charged on several super options. Australian Retirement Trust has the most expensive percentage-based fees.

Percentage-based fees really begin to sting when the super balance grows over time. This was evident when comparing a $50,000 to a $500,000 balance.

Hostplus Shares Plus option had a stronger performance over the 10 years. However, this marginal 0.04% performance improvement on Australian Super would need to be factored in when looking at fees overall.

For that performance, Hostplus would cost $172 more annually on a $50,000 balance. So considering that this balance would likely grow considerably over a 10 year time frame, that $172 difference would also grow as Hostplus’ total percentage based fees are 0.23% more than Australian Super.

This article is for informational purposes only and does not constitute as an endorsement or recommendation to purchase any specific mentioned product.

- https://www.australiansuper.com/campaigns/super-moments

- https://www.australiansuper.com/careers/our-teams

- https://www.australiansuper.com/-/media/australian-super/files/about-us/media-releases/australiansuper-and-lucrf-super-complete-merger.pdf

- https://www.thinkingaheadinstitute.org/research-papers/the-worlds-largest-pension-funds-2022/