Comprehensive Guide: HECS Debt

Last Updated on 27 January 2024 by Ryan Oldnall

Many Australians who have pursued higher education at a public university are likely to have incurred a HECS debt as a consequence of their enrollment. This article will explore every aspect of the HECS-HELP program.

This is Your Comprehensive Guide to everything you will ever need to know about your HECS debt, including should you pay it off early and what happens to your HECS debt when you die.

What Is HECS Debt

HECS-HELP debt, referred to as the Higher Education Contribution Scheme (HECS) – Higher Education Loan Program (HELP), aims to offer financial assistance to qualified students who receive Commonwealth support.

It allows them to manage their student contribution by means of a loan arrangement, effectively helping to cover their required payments.

Universities often have Commonwealth Support Places (CSP), especially within their bachelor degrees and select post-graduate programs.

Under a Commonwealth Support Place (CSP), the Australian Government pays a significant portion of the student’s university fees, and the difference is the individual’s ‘student contribution amount’.

The CSP is the subsidy the Commonwealth provides; it is not a loan and does not require repayment. The ‘Student Contribution Amount’ is the subsidized amount that is effectively the HECS debt loan.

The Government’s HECS-HELP loan does not cover student costs such as textbooks, study materials, laptops, or University Accommodation.

Students are expected to cover these expenses themselves. Overseas other college or university students have ‘student loans’ which can be used for such items.

HECS Debt Repayment Threshold

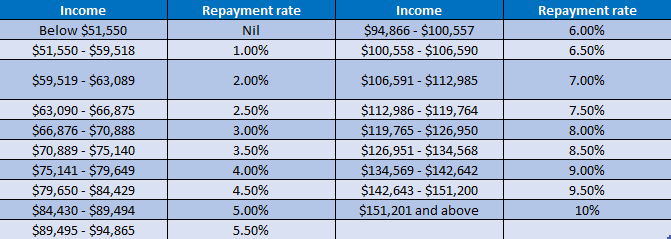

When Australians begin earning an income, they are required to make HECS repayments above a certain threshold. The HECS Debt Repayment Thresholds for 2023-2024 are listed below:

It is important to note that this table refers to taxable income plus any total net investment losses, reportable fringe benefits, reportable super contributions, and exempt foreign income. The repayment amount is based on a person’s taxable income and not on the volume of debt.

For those that work in the not-for-profit sector, they will likely experience ‘grossing up’ of their salary. This is due to the ability to salary package up to $18,549 of their taxable income. To understand how this may impact on your HECS repayments use my Salary Packaging Calculator.

Additionally, for those that are able to salary package, they have the added benefit of paying less tax and higher HECS repayments. This is just one benefit of working in the not-for-profit sector.

What are HECS Debt Repayments

When your income goes over the above thresholds you will become liable for HECS debt repayments. It is an individual’s responsibility to ensure their mandatory HECS Debt repayments are paid each financial year.

This is often done by informing your payroll department of your HECS debt. They will then automatically deduct from your income under the pay-as-you-go (PAYG) withholding system.

This will ensure that the correct amount is withheld each pay period for the purposes of your HELP debt.

Failure to not declare your HECS-HELP debt is not illegal but could result in a significant tax bill. Depending on your income, your repayments may be several thousands of dollars and you will have to pay this amount when lodging your tax return.

So unless you have kept that money aside it would be a significant sum of money to pay.

Therefore, it is recommended to always notify your employer if you have a HECS-HELP debt so they can ensure you are making the mandatory repayments.

Moreover, for those that work in the not-for-profit sector. You will need to make an ‘additional deduction’ as a result of the ‘grossing up’ which was discussed above.

What Is Indexation On HELP Debt

Indexation plays a crucial role in the HECS-HELP scheme, by adjusting the debt’s value to account for inflation. Unlike traditional interest charges imposed by banks on loans, the Australian Government does not apply interest to HELP debts.

Indexing is employed to ensure that the debt remains in line with the impact of inflation over time.

In a hypothetical scenario where the government loaned you $30,000 in 2018 and no repayments were made for 5 years, the government’s objective would still be to recover the initial loan amount of $30,000.

However, as inflation erodes the purchasing power of that $30,000 over the years, the actual value of the debt would have decreased in terms of what it can purchase in the present day.

Indexation addresses this depreciation and guarantees that the government can recoup the original loan amount in real terms, adjusted for inflation.

For instance, if you had a $50,000 HECS-HELP debt balance on June 1, 2023, the government would have applied an indexation rate of 7.1%. This would result in your new debt balance increasing to $53,550, reflecting a $3,550 increase.

The government implements indexation on June 1st each year, using the Consumer Price Index (CPI) figure released in March.

It is worth noting that while indexation leads to an increase in the debt balance, it is still significantly more affordable than paying interest.

The purpose of indexing in the context of HECS-HELP debt is to ensure that the government is repaid the same value of money they initially loaned you during your period of study, accounting for the impact of inflation.

How To Check Your HECS Debt Balance

To check your HECS Debt balance you will need to do the following:

1. login into myGov

2. Go to ‘Australian Taxation Office’

3. Under Loan Accounts Select ‘Higher education loan program (HELP)’

This will display a transaction history of your HELP debt for approximately the past 10 years.

On the left-hand side, under Debit (DR), it will indicate any fees charged, including the amount of indexation applied to your student debt.

On the right-hand side, under Credit (CR), it will list the compulsory HELP repayments you have made each year.

The far right-hand side shows your balance, which is updated twice a year. It is adjusted when indexation is applied, and again when you make your compulsory repayment.

Why Is My HECS Debt Not Going Down

For some people, it just feels like their HECS debt isn’t going down but for some, it’s actually the case. Take for example an individual who has a taxable income of $55,000.

Using the above repayment table, we can see their repayment is equivalent to 1% of their total taxable income. Thus, their student loan repayment amount is $550.

In the given scenario, assuming a $50,000 balance on June 1, 2023, and an indexation rate of 7.1%, the debt balance would increase by $3,550, resulting in a total debt balance of $53,550.

If the individual makes a compulsory HECS-HELP repayment of $550, we can calculate the remaining debt as follows:

Total debt balance after indexation: $53,550 Minus the compulsory repayment amount: $550 Remaining debt: $53,000

Therefore, after fulfilling the compulsory repayment, the individual’s remaining HECS-HELP debt would amount to $53,000.

This is of particular concern for some in 2023 with inflation being so high. However, using ATO’s historical index rates for the past decade, the average rate of inflation (including 2023) is just 2.44%

Should You Pay Off Your HECS Debt Early

The short answer is, it depends. For many your student HECS-HELP debt is the lowest form of debt you can own. The fact that the balance is indexed and not charged interest makes this the case.

Therefore for many people paying off other debts such as after-pay, credit cards, car loans, personal loans, and home loans should be prioritised.

That being said, however, there are a few instances where an individual may consider paying off their student debts sooner.

If the individual is looking to purchase a home or investment property, having a HECS-HELP debt can lower their borrowing capacity. So through paying off this debt (if a reasonable amount) will increase their borrowing capacity.

If an individual has a relatively small HECS-HELP debt that is likely to be paid off within the same financial year, it can be advantageous to consider paying off the debt in full, if feasible.

This is because the debt is subject to indexation BEFORE your annual contribution is applied. Waiting until after June 1 would mean missing out on this opportunity.

For instance, let’s say your HECS-HELP debt is $10,000, and your compulsory payments based on your income are expected to cover this amount.

By paying off the debt before indexing is applied, typically recommended at least four business days before June 1, you could effectively save yourself $710. You would then receive the money you had paid throughout the year as a tax refund.

It is important to note that this strategy applies specifically to situations where the debt is small and likely to be cleared within the same financial year.

Each individual’s circumstances may vary, so it is advisable to assess your situation and consult with a tax professional or financial advisor to determine the most suitable approach for managing your HECS-HELP debt.

What Is The Difference Between HECS and FEE-HELP?

HECS-HELP and FEE-HELP are two different components of the Higher Education Loan Program in Australia, each catering to specific student cohorts and educational circumstances.

HECS-HELP is specifically designed for eligible Commonwealth supported students enrolled in higher education courses at Australian universities. It supports these students by providing a loan to cover their required student contribution, which represents a portion of their tuition fees.

The repayment of the HECS-HELP loan is facilitated through the tax system once the student’s income surpasses a certain threshold.

FEE-HELP, on the other hand, is available to eligible students enrolled in fee-paying higher education courses, typically offered by private universities or institutions.

FEE-HELP assists these students in loaning the full amount of their tuition fees. Similar to HECS-HELP, FEE-HELP provides a loan for tuition fees, and repayment is made through the tax system when the student’s income exceeds the repayment threshold.

It’s important to note that Commonwealth supported students are eligible for HECS-HELP, while those not covered by the Commonwealth Supported Place (CSP) arrangements would be eligible for FEE-HELP instead.

What Happens To HECS Debt When You Die

When a person dies their HELP debt dies with them. It is likely the only form of debt that gets written off when a person passes away.