Best Global ETFs On The Australian ASX

Last Updated on 19 February 2024 by Ryan Oldnall

Investors on the ASX typically construct a portfolio with core holdings, often comprising a domestic ETF tracking the ASX 200/300 and an international or global ETF. Additionally, investors may diversify with satellite holdings, such as ETFs focused on Australian Real Estate Investment Trusts (AREITs) or thematic ETF options like FANG or ACDC

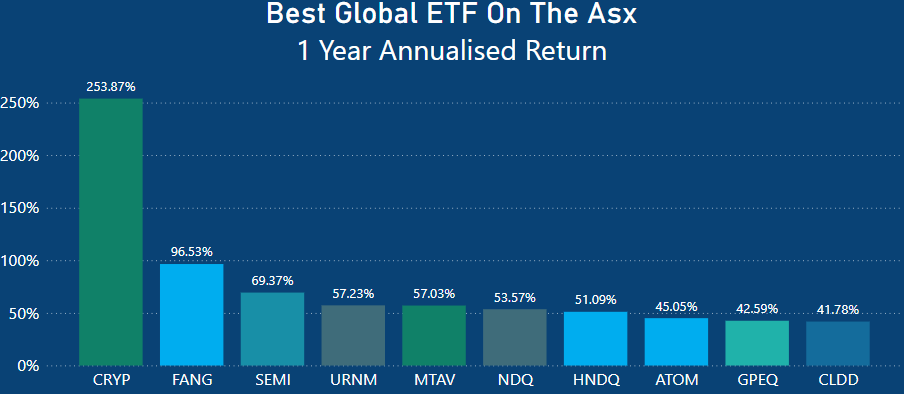

But what is the best Global ETF on the ASX? Utilizing ASX data and focusing on those listed as ‘Global,’ we’ll break down the best-performing ETFs in 2023. Additionally, we’ll examine the 3 and 5-year annualized returns to provide a longer-term perspective.

Best Global ETFs On The Australian ASX In 2023

Betashares Crypto Innovators ETF (CRYP)

The inclusion that might raise some eyebrows for certain investors is the standout performer among global ETFs on the ASX in 2023, Betashares Crypto Innovators ETF (CRYP), boasting an impressive return of 253.87%. CRYP is strategically designed to offer investors exposure to the cryptocurrency economy.

By strategically investing in up to 50 leading crypto entities, which include companies like Coinbase, Riot Blockchain, and MicroStrategy, CRYP aims to tap into the potential of the continually evolving crypto landscape. I have previously covered the Best Crypto ETFs In Australia.

Global X FANG+ ETF (FANG)

Securing the second position with a considerable lead is the consistently popular Global X FANG+ ETF (FANG), boasting an impressive 96.53% return.

FANG is comprised of only 10 holdings, featuring leading technology giants like NVIDIA Corp, Meta Platforms Inc (formerly Facebook), Alphabet Inc, Microsoft Corp, Amazon Inc, Broadcom Inc, Netflix Inc, Snowflake Inc, Apple Inc, and Tesla Inc.

Global X Semiconductor ETF (SEMI)

Global X Semiconductor ETF (SEMI) delivered a return of 69.37%. SEMI aims to invest in companies positioned to benefit from the widespread adoption of tech-enabled devices that depend on semiconductors. This encompasses the development and manufacturing of semiconductors [2].

Sprott Uranium Miners ETF (URNM)

Sprott Uranium Miners ETF (URNM) achieved a return of 57.23% in 2023. URNM aims to mirror the performance of an index (before fees and expenses) providing exposure to a portfolio of leading companies in the global uranium industry [3].

Betashares Metaverse ETF (MTAV)

Betashares Metaverse ETF (MTAV) yielded a fractional return compared to URNM, with a 57.03% return. MTAV aims to track the performance of an index (before fees and expenses) that provides exposure to a portfolio of leading global companies involved in building, developing, and operating the Metaverse [4].

The Metaverse is often described as the next iteration of the internet, combining our digital and physical lives. To get an understanding of the MTAV ETF, consider some of its top holdings, including Nintendo, Meta (Facebook), NVIDIA, Sony, and Electronic Arts (EA) [4].

BetaShares Nasdaq 100 ETF (NDQ)

BetaShares Nasdaq 100 ETF (NDQ) has continued to grow in popularity with a remarkable 53.57% return in 2023. Interest in NDQ is increasing, and when reviewing the Best Performing ETFs in Australia over the Last 5 years, NDQ emerged as the top performer.

BetaShares Nasdaq 100 ETF – Currency Hedged (HNDQ)

BetaShares Nasdaq 100 ETF – Currency Hedged (HNDQ) closely mirrors the performance of NDQ with a 51.09% return. HNDQ is the currency-hedged version of NDQ.

Global X Uranium ETF (ATOM)

Global X Uranium ETF (ATOM) returned 45.05% in 2023. ATOM invests in companies involved in uranium mining and the production of nuclear components, including those in extraction, refining, exploration, or manufacturing of equipment for the uranium and nuclear industries [5].

Vaneck Global Listed Private Equity ETF (GPEQ)

Vaneck Global Listed Private Equity ETF (GPEQ) returned 42.59% in 2023. According to Vaneck, GPEQ offers investors a diversified portfolio of the 50 largest and most liquid global listed private equity companies [6].

In essence, GPEQ invests in private equity firms whose shares are publicly traded on a stock exchange. These companies are often involved in making investments in private businesses or assets, and their shares can be bought and sold by investors on the open market.

Betashares Cloud Computing ETF (CLDD)

Betashares Cloud Computing ETF (CLDD) concludes our list of the top 10 performing global ETFs in 2023, showcasing a substantial return of 41.78%. CLDD offers investors exposure to key players in the global cloud computing industry.

Currently, CLDD comprises 44 holdings, featuring notable companies such as website builders WIX and Shopify [6].

Best Global ETFs On The Australian ASX Over 3 years

Betashares Global Energy Cos ETF-Currency Hedged (FUEL)

The leading performer in the 3-year annualized global ETF category is Betashares Global Energy Cos ETF-Currency Hedged (FUEL), achieving an impressive return of 22.86%.

FUEL ETF holds the most substantial global energy companies (excluding Australia) while being hedged into Australian dollars. Among the notable holdings of FUEL are some of the world’s largest petroleum companies, including Shell, Exxon Mobil, and BP.

VanEck Morningstar Wide Moat ETF (MOAT)

Securing the second spot with a return of 16.73% is VanEck Morningstar Wide Moat ETF (MOAT). This ETF provides investors exposure to a diversified portfolio of attractively priced US companies that possess sustainable competitive advantages, as determined by Morningstar’s equity research team.

The emphasis is on quality US companies with sustainable competitive advantages, often referred to as “wide economic moats” [8]. For those seeking a detailed understanding of what a moat is, refer to Morningstar’s MOAT resource [9].

Global X FANG+ ETF (FANG)

The previously mentioned FANG secures the 3rd position with a noteworthy return of 15.83%. While this return remains robust, it exemplifies the remarkable performance of the year 2023, highlighted by entities like NVIDIA, which experienced staggering growth of 239% [10].

SPDR S&P 500 ETF (SPY)

The SPDR S&P 500 ETF, SPY, delivered a return of 14.47%. SPY aims to generate investment results that, before expenses, closely correspond to the price and yield performance of the S&P 500.

Despite its popularity, SPY presents an added complexity of being domiciled in the U.S. Consequently, Australian investors will be required to file a W-8BEN with the American IRS.

iShares S&P 500 ETF (IVV)

iShares S&P 500 ETF (IVV) achieved a 14.20% return over a 3-year annualized period, mirroring the performance of the S&P 500 Index.

IVV is a low-cost fund providing exposure to the top 500 U.S. stocks, offering a decent option for international diversification and long-term growth opportunities in the wider US market.

iShares Global 100 ETF (IOO)

The ASX-listed iShares Global 100 ETF (IOO), posted a 3-year annualized return of 14.22%. IOO is a favored choice among investors for its global coverage, investing in the top 100 companies worldwide. However, it’s worth noting that approximately 70% of this exposure is in the U.S., a point discussed in my IOO vs VGS article.

BetaShares Nasdaq 100 ETF (NDQ)

NDQ once again secures a top position as a strong performer over a 3-year annualized period with a 13.90% return.

iShares Core MSCI World Ex Aus ESG Leaders ETF (IWLD)

Following closely behind NDQ is the iShares Core MSCI World Ex Aus ESG Leaders ETF, IWLD, boasting a 13.59% return. IWLD’s objective is to mirror the performance of the MSCI World Ex Australia Custom ESG Leaders Index, before fees and expenses.

This ETF is designed to assess the performance of global, developed-market large and mid-capitalization companies with superior sustainability credentials relative to their sector peers [11].

S&P 500 Equal Weight ETF (QUS)

The S&P 500 Equal Weight ETF, QUS, recorded a 13.48% return on a 3-year annualized basis. QUS can be likened to its Australian equivalent, MVW.

QUS aims to replicate the performance of the S&P 500 Equal Weight Index (before fees and expenses), offering exposure to 500 prominent listed U.S. companies, with each holding in the index being equally weighted.

VanEck MSCI International Quality ETF (QUAL)

VanEck MSCI International Quality ETF, QUAL, concludes the list of the top 10 global performing ETFs over 3 years with a respectable 12.93% return. QUAL provides investors exposure to a diverse portfolio of high-quality international companies in developed markets (excluding Australia).

QUAL ETF selects companies based on fundamental criteria such as high return on equity, earnings stability, and low financial leverage.

Best Global ETFs On The Australian ASX Over 5 years

BetaShares Nasdaq 100 ETF (NDQ)

The leading global ETF on the ASX, as expected by many, is NDQ, showcasing an impressive 22.81% 5-year annualized return.

Betashares Global Cybersecurity (HACK)

The ETF Securing the second spot is Betashares Global Cybersecurity ETF, HACK, with a commendable return of 19.39%. HACK provides exposure to key players in the global cybersecurity sector.

BetaShares Global Sustainability Leaders ETF (ETHI)

BetaShares Global Sustainability Leaders ETF, ETHI, delivered a decent 18.40% return over the 5-year period on an annualized basis.

ETHI consists of a portfolio of significant global stocks recognized as “Climate Leaders,” having undergone screenings to exclude companies with direct or significant exposure to fossil fuels or engaged in activities inconsistent with responsible investment considerations [13].

Global X Battery Tech & Lithium ETF (ACDC)

Global X Battery Tech & Lithium ETF, ACDC, achieved an average return of 18.30% over the 5 years. ACDC invests in companies across the lithium cycle, encompassing mining, refinement, and battery production, transcending traditional sector and geographic definitions. I have previously conducted an in-depth review of the ACDC ETF.

The Morningstar Global Technology ETF (TECH)

The Morningstar Global Technology ETF, TECH, has demonstrated a robust 17.62% average return over the past 5 years. TECH focuses on the expanding adoption of technology, targeting companies primarily involved in cloud computing [14].

VanEck Morningstar Wide Moat ETF (MOAT)

VanEck Morningstar Wide Moat ETF (MOAT) posted a 17.59% return over a 5-year annualized period, trailing TECH by a marginal 0.03%.

The ASX-listed iShares Global 100 ETF (IOO), posted a 3-year annualized return of 14.22%

VanEck MSCI International Quality ETF (QUAL) & SPDR S&P 500 ETF (SPY)

VanEck MSCI International Quality ETF, QUAL, and SPY both achieved annualized 5-year returns of 17.17% and 16.39%, respectively, followed by IOO with 16.21%.

iShares Global 100 ETF (IOO)

iShares Global 100 ETF (IOO) returned 16.21% over a 5-year annualized period, which was a decent result for the ETF that invests in the world’s top 100 global companies.

iShares S&P 500 ETF (IVV)

Rouind out the top 10 performing global ETFs over the past 5 years is the second-largest global ETF, iShares S&P 500 ETF, IVV, with a return of 16.13%.

According to December 2023 ASX data [1], IVV had funds under management totaling $6,457 million, slightly lower than Vanguard MSCI Index International Shares ETF, VGS, which had $6,490 million.

IVV stands out as a highly popular choice, offering exposure to the U.S. S&P 500 and, unlike SPY, being domiciled in Australia.

Summary – Best international ETF

For investors seeking international exposure through ETFs, the choices are diverse. The standout performers of 2023 were predominantly ETFs investing in technology and lithium companies.

This tech-centric trend persists in the 3 and 5-year annualized performances, with a significant portion of the top 10 ETFs focusing on leading technology companies.

Highlighting that Environmental, Social, and Governance (ESG) ETFs, like ETHI, have demonstrated robust and sustained performance over the long term. This places them in direct competition with non-ESG-related ETFs, showcasing investors’ growing recognition of the value of ESG considerations in their portfolios.

This article does not serve as an endorsement or recommendation for products mentioned in the article. The information presented here is based on referenced sources and is accurate as of the date of January 19, 2024, using December ASX Data. Please note that these articles are written sometime before their publication date.

The information provided in this content is for informational purposes only and should not be considered as financial, investment, or professional advice. We recommend consulting with a qualified expert or conducting your own research before making any financial decisions.

The accuracy, completeness, or reliability of the information cannot be guaranteed, and the provider shall not be held responsible for any actions taken based on the information contained in this content.

- https://www.asx.com.au/issuers/investment-products/asx-funds-statistics

- https://www.globalxetfs.com.au/funds/semi/

- https://www.betashares.com.au/fund/global-uranium-etf/

- https://www.betashares.com.au/fund/metaverse-etf/

- https://www.globalxetfs.com.au/funds/atom/

- https://www.vaneck.com.au/etf/alternatives/gpeq/holdings/

- https://www.betashares.com.au/fund/global-energy-companies-etf/

- https://www.vaneck.com.au/etf/equity/moat/snapshot/

- https://www.vaneck.com/us/en/investments/morningstar-wide-moat-etf-moat/what-makes-a-moat-white-paper.pdf/

- https://www.google.com/finance/quote/NVDA:NASDAQ?sa=X&ved=2ahUKEwidv4OQ4OiDAxWY8zgGHe7-CVMQ3ecFegQIXRAf

- https://www.blackrock.com/au/individual/products/283117/ishares-core-msci-world-ex-australia-esg-etf

- https://www.vaneck.com.au/etf/equity/qual/snapshot/

- https://www.betashares.com.au/fund/global-sustainability-leaders-etf/

- https://www.globalxetfs.com.au/funds/tech/