Best Performing Vanguard ETFs Last 10 Years

Last Updated on 20 February 2024 by Ryan Oldnall

Vanguard is an absolute powerhouse and is popular across the globe. Vanguard Global was first established in 1975 and currently manages 204 funds in the US and 227 outside of the US market. Vanguard boasts over 50 million investors worldwide, managing over $10 trillion in assets.

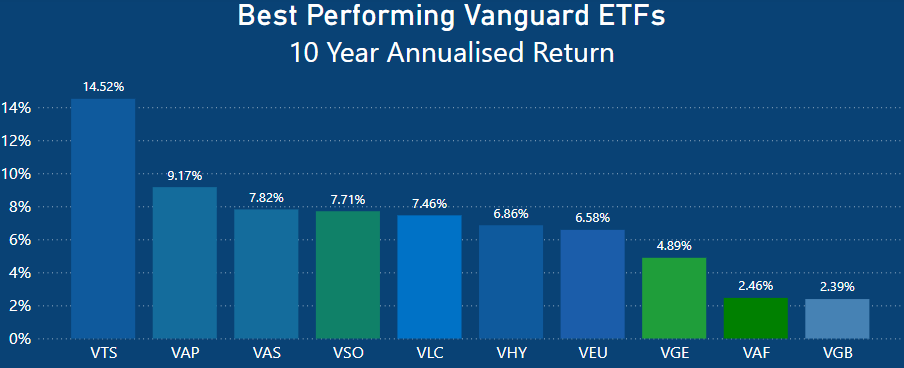

In this article, we will explore the best-performing ASX-listed Vanguard ETF over the past 10 years. This analysis will be conducted using Morningstar Performance historical data as of December 31, 2023, along with ASX statistical data for management expenses ratio and assets under management.

What is Vanguard’s best performing ETF?

Vanguard US Total Market Shares Index ETF, VTS

Vanguard’s best-performing ETF is the Vanguard US Total Market Shares Index ETF, VTS. With a 14.52% 10-year annualized return, VTS is significantly ahead of all other Vanguard ASX-listed ETFs. It is particularly popular among investors seeking exposure to the US market.

The VTS ASX ETF offers exposure to the entire US share market and is part of the world’s largest mutual fund. The ETF invests in around 4,000 companies listed in the United States.

Given its extensive holdings, one would expect it to be one of the most popular ETFs on the ASX.

However, it comes with a significant downside for many investors—it is domiciled in the US. This means that during Australian tax time, your return could be a bit more complicated, and you would need to lodge a W-8BEN[4] with the American IRS to avoid double taxation.

Nevertheless, for those who don’t mind the extra paperwork and are willing to put some thought into tax considerations, VTS is a highly appealing option.

Vanguard Australian Property Securities Index ETF, VAP

Vanguard Australian Property Securities Index ETF, VAP, has delivered an impressive 10-year annualized return of 9.17%. This ETF strategically invests in a diversified blend of Australian real estate investment trusts (A-REITs), encompassing residential, office, retail, and industrial assets.

Remarkably, VAP stands out as one of the highest-performing ASX ETFs over the past decade, particularly noteworthy for its domestic focus. As discussed in my article covering the best-performing ETFs over the last 10 years, VAP has demonstrated strong performance in the Australian market.

Vanguard Australian Shares Index ETF, VAS

Vanguard Australian Shares Index ETF, VAS, which I have extensively covered, delivered an average return of 7.82% over the last 10 years. Notably, VAS is not only the most popular ETF on the ASX but also holds the title of the largest, boasting an impressive $13.2 billion in assets under management [5].

Its popularity stems from its tracking of the ASX 300, which means it captures the performance of the 300 largest listed Australian companies.

Vanguard MSCI Australian Small Companies Index ETF, VSO

Vanguard MSCI Australian Small Companies Index ETF, VSO, returned a slightly lower yield than VAS with a 7.71% performance over the last 10 years. VSO tracks the MSCI Australian Shares Small Cap Index and holds approximately 194 holdings at the time of writing [6].

Vanguard MSCI Australian Large Companies Index ETF, VLC

On the other hand, Vanguard MSCI Australian Large Companies Index ETF, VLC, returned an annualized result of 7.46% over the same period, which was 0.25% less than that of VSO.

VLC focuses on Australia’s largest companies and, as of the latest information, holds around 17 positions, including notable names like BHP, CBA, CSL, NAB, and Westpac [7].

Analyzing the holdings, BHP represents 18.70%, CBA at 13.97%, and CSL at 10.09%. Remarkably, just these three holdings alone constitute 42.76% of the ETF [7]. Consequently, the long-term performance of the ETF is notably influenced by a few select companies.

Vanguard Australian Shares High Yield ETF, VHY

Vanguard Australian Shares High Yield ETF, VHY, returned a 6.86% annualized return over the past 10 years. VHY, a topic I’ve covered extensively, is a favorite among dividend investors.

The ETF’s holdings are strategically geared towards ASX companies that consistently pay out high dividend yields to their shareholders.

Vanguard All-World ex-US Shares Index ETF, VEU

Moving on to Vanguard All-World ex-US Shares Index ETF, VEU, it delivered an average return of 6.58% over the last decade. VEU aims to track the return of the FTSE All-World ex US Index before accounting for fees, expenses, and taxes [8].

VEU ETF provides exposure to a diverse range of the world’s largest companies listed in major developed and emerging countries outside the US [8]. With approximately 3772 holdings, it includes names like Nestle, Novo Nordisk, Samsung, and Taiwan Semiconductor Manufacturing.

However, similar to VTS, the downside to VEU is its US domicile, requiring the lodging of a W8-BEN for Australian investors.

Vanguard FTSE Emerging Markets Shares ETF, VGE

Vanguard FTSE Emerging Markets Shares ETF, VGE, delivered an average return of 4.89% over the past 10 years. VGE tracks the return of the FTSE Emerging Markets All Cap China, with approximately 4661 holdings [9].

Vanguard Australian Fixed Interest Index ETF, VAF

Vanguard Australian Fixed Interest Index ETF, VAF, returned a modest 2.46% over a 10-year annualized period. Fixed interest ETFs, including VAF, are not expected to match the returns of growth or dividend-paying ETFs.

Investors often include fixed income in their portfolio for defensive purposes, seeking lower risks and stability during market volatility.

Vanguard Australian Government Bond Index ETF, VGB

Vanguard Australian Government Bond Index ETF, VGB, had the lowest top 10 result with a 10-year annualized return of 2.39%. This ETF invests in Australian Government bonds, providing stable income and outperforming growth assets like VTS, VAP, and VAS.

Investors in government bonds typically prioritize stability and income, considering them less risky than growth assets, such as shares and property, to diversify their investment portfolio [10].

Best Performing Vanguard ETFs Last 10 Years Recap

-

- Vanguard US Total Market Shares ETF (VTS)

- Performance: 14.52%

- Expense Ratio: 0.03%

- AUM: $3,654 million

- Vanguard Australian Property Secs ETF (VAP)

- Performance: 9.17%

- Expense Ratio: 0.23%

- AUM: $2,458 million

- Vanguard Australian Shares ETF (VAS)

- Performance: 7.82%

- Expense Ratio: 0.07%

- AUM: $13,169 million

- Vanguard MSCI Australian Small Coms ETF (VSO)n

- Performance: 7.71%

- Expense Ratio: 0.30%

- AUM: $799 million

- Vanguard MSCI Australian Large Coms ETF (VLC)n

- Performance: 7.46%

- Expense Ratio: 0.20%

- AUM: $207 million

- Vanguard Australian Shares High Yld ETF (VHY)

- Performance: 6.86%

- Expense Ratio: 0.25%

- AUM: $3,191 millionn

- Vanguard All-World ex-US Shares ETF (VEU)

- Performance: 6.58%

- Expense Ratio: 0.08%

- AUM: $2,716 million

- Vanguard FTSE Emerging Markets Shrs ETF (VGE)

- Performance: 4.89%

- Expense Ratio: 0.48%

- AUM: $724 million

- Vanguard Australian Fixed Interest ETF (VAF)

- Performance: 2.46%

- Expense Ratio: 0.10%

- AUM: $1,796 million

- Vanguard Australian Government Bond ETF (VGB)n

- Performance: 2.39%

- Expense Ratio: 0.20%

- AUM: $1,022 million [11]

- Vanguard US Total Market Shares ETF (VTS)

Summary – Are Vanguard ETFs A Good Buy?

While Vanguard ETFs undoubtedly offer strong investment opportunities, selecting the right ETF for your needs is a crucial decision. VTS stands out as Vanguard’s best-performing ASX-listed ETF over the past 10 years, boasting an impressive 14.52% annualized return.

Surpassing the second-place VAP by 5.35%, VTS has demonstrated significant outperformance. However, the additional complexities involved in submitting a W8-BEN and managing a more intricate tax return prompt many investors to explore alternative options.

Choices such as Vanguard MSCI Index International Shares ETF (VGS) or iShares S&P 500 ETF (IVV), which have slightly outperformed VTS in the last decade, emerge as attractive alternatives.

Overall, regardless of the specific ETF you choose, Vanguard offers a diverse range of options and remains a trusted name in the world of ETFs.

This article does not serve as an endorsement or recommendation for products mentioned in the article. The information presented here is based on referenced sources and is accurate as of the date of January 9, 2024, with ASX November 2023 Statistical Data. Please note that these articles are written sometime before their publication date.

The information provided in this content is for informational purposes only and should not be considered as financial, investment, or professional advice. We recommend consulting with a qualified expert or conducting your own research before making any financial decisions.

The accuracy, completeness, or reliability of the information cannot be guaranteed, and the provider shall not be held responsible for any actions taken based on the information contained in this content.

-

- https://www.vanguard.com.au/adviser/about-us/our-history

- https://www.vanguard.com.au/corporate/

- https://www.morningstar.com.au/

- https://blog.stockspot.com.au/w8ben/

- https://www.vanguard.com.au/personal/invest-with-us/etf?portId=8205

- https://www.morningstar.com/etfs/xasx/vso/portfolio

- https://www.morningstar.com.au/investments/security/ASX/VLC

- https://www.vanguard.com.au/adviser/invest/etf?portId=0991

- https://www.morningstar.com.au/investments/security/ASX/VGE/portfolio

- https://moneysmart.gov.au/investments-paying-interest/bonds

- https://www.asx.com.au/issuers/investment-products/asx-funds-statistics