Vanguard Super vs Hostplus: Can the Newcomer Compete?

Last Updated on 26 January 2024 by Ryan Oldnall

Vanguard Super is a relative newcomer to the Australian Super Fund industry, launching in October 2022. Vanguard announced in May 2023 that they had $500 million in assets under management with over 10,000 members to date [1].

Hostplus Super on the other hand is a well-established Superannuation provider with over 1.77 million members and $102.6 billion in assets under management [2].

So let’s explore Vanguard Super vs Hostplus Super. Who has the better performance, fees and what is the cost on a $50,000 super balance?

Vanguard Super Performance vs Hostplus Performance

With Vanguard Super having historical performance data spanning less than a year, we will assess its short-term performance over one month, three months, and six months.

The performance information was collected from the individual super funds’ websites and is current as of July 31, 2023.

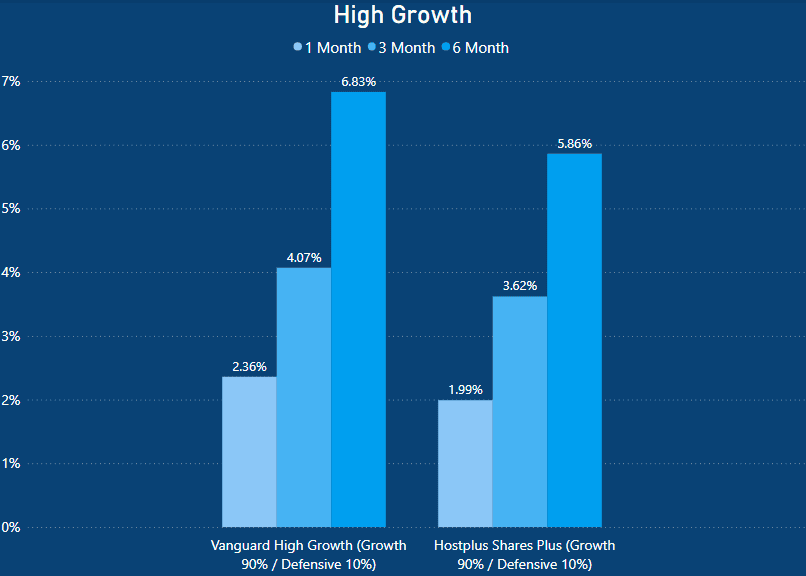

Vanguard Super High Growth vs Hostplus Shares Plus

Vanguard’s High Growth option is split between 90% growth assets and 10% defensive assets. This is the same as Hostplus’ Shares Plus option which is weighted as being 90% growth and 10% defensive.

Analyzing the data, we can see that Vanguard has performed better across the selected time frames.

Vanguard has outperformed Hostplus at the 1 month, 3 month and 6 month marks. Overall, Vanguard has outperformed Hostplus by 0.97% after 6 months.

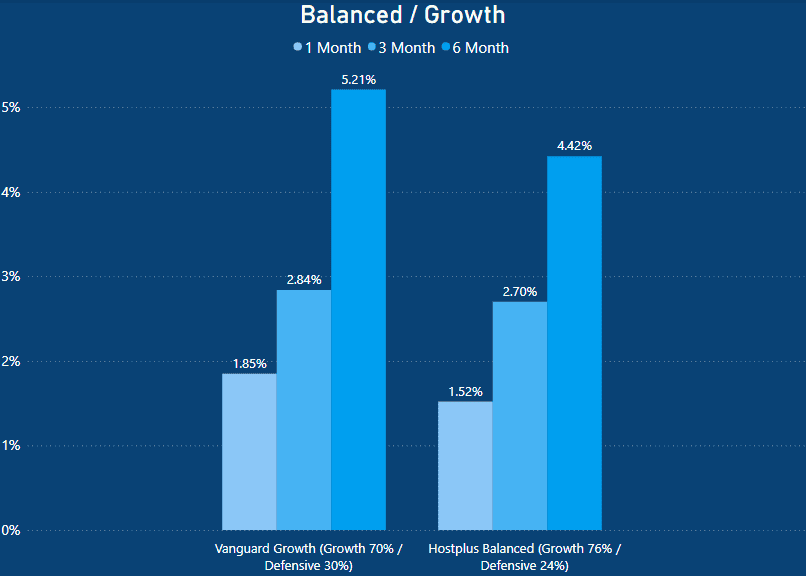

Vanguard Super Growth vs Hostplus Balanced

Vanguard’s Growth option is split between 70% growth assets and 30% defensive assets. Whereas Hostplus Balanced is split 76% growth assets and 24% defensive assets.

Interestingly, Vanguard’s balanced option is split 50/50. So to get a more accurate comparison we have opted to compare its Growth option.

When evaluating the performance of the two options, Vanguards Growth option is the winner across the selected time period. This is despite it having a target growth allocation of 70% in comparison to Hostplus’ 76%.

Vanguards growth option returned 0.79% more in the 6 month time frame than that of Hostplus’ balanced option.

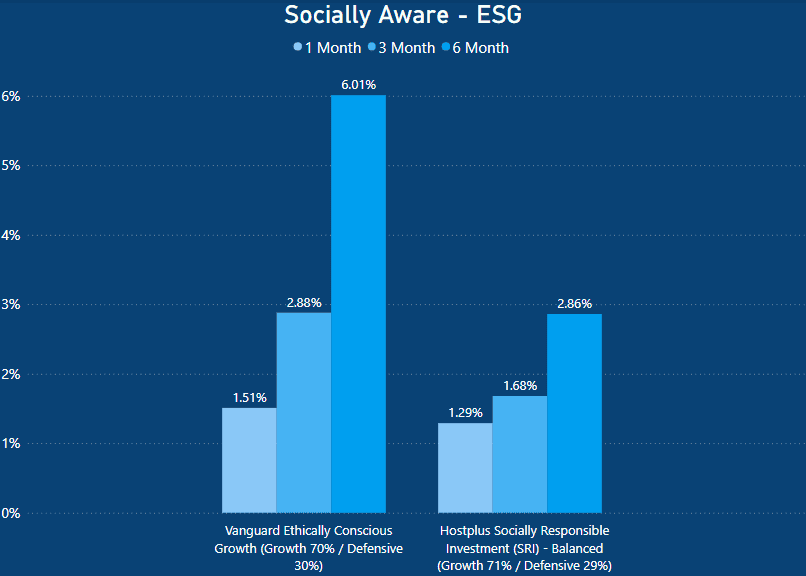

Vanguard Super Ethically Conscious Growth vs Hostplus Socially Responsible Investment Balanced

Vanguard’s Ethically Conscious Growth option is split between 70% growth assets and 30% defensive assets. Whereas Hostplus Socially Responsible Investment is split 71% growth assets and 29% defensive assets.

The performance difference is quite staggering so much so, that I had to re-check the performance data a few times!

It is quite clear that Vanguard is the better performer when it comes to ethical investing, but why such a performance difference? I dug into the investment options to find out.

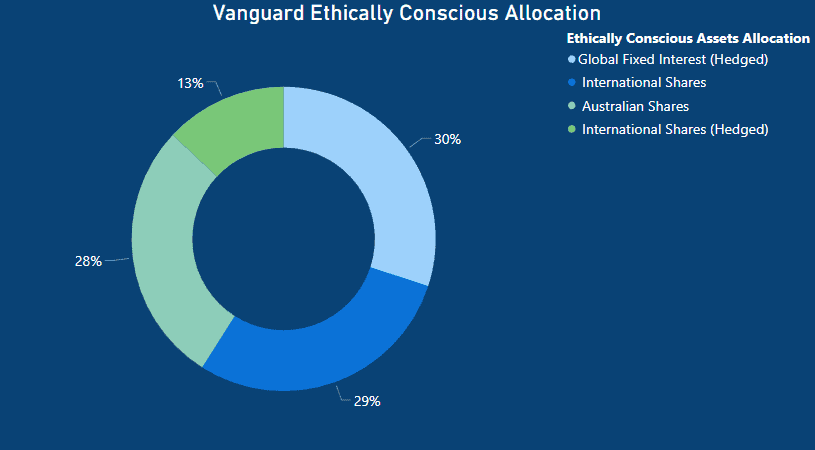

Vanguards Ethically conscious growth option has a high weighting in international shares with a total of 42%. This is made up of 13% international shares which are hedged and a further 29% in non-hedged international shares.

A further 28% is invested into Australian domestic shares this exposure to the stock market makes up the 70% growth allocation.

For the defensive portion, this is made up of 30% in hedged global fixed interest.

All these asset allocations are all done with an environmental, social and governance (ESG) lens. Vanguard notes they exclude companies involved in such activities as fossil fuels and tobacco.

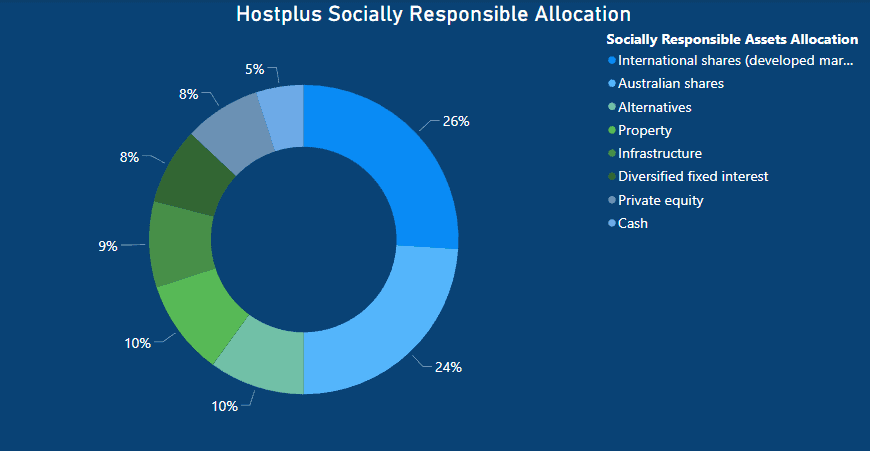

Similarly, Hostplus’ socially responsible option invests over a quarter of its allocation (26%) into international shares. With a further 24% placed in the domestic share market. Thus, 50% of the portfolio is allocated to shares.

Unlike the Vanguard ethically conscious product which invests in 4 key areas only. Hostplus has no less than 8 individual allocations.

Like Vanguard, Hostplus tries to invest in assets that fit within its ESG model. Hostplus advertises these as being, clean water, alternative foods, community infrastructure, green buildings, green bonds, health care, and renewable energy [3].

They avoid where possible, fossil fuels, controversial weapons, gambling, live animal export, tobacco, for-profit detention, human rights breaches, uncertified palm oil, and very poor ESG policies and systems [3].

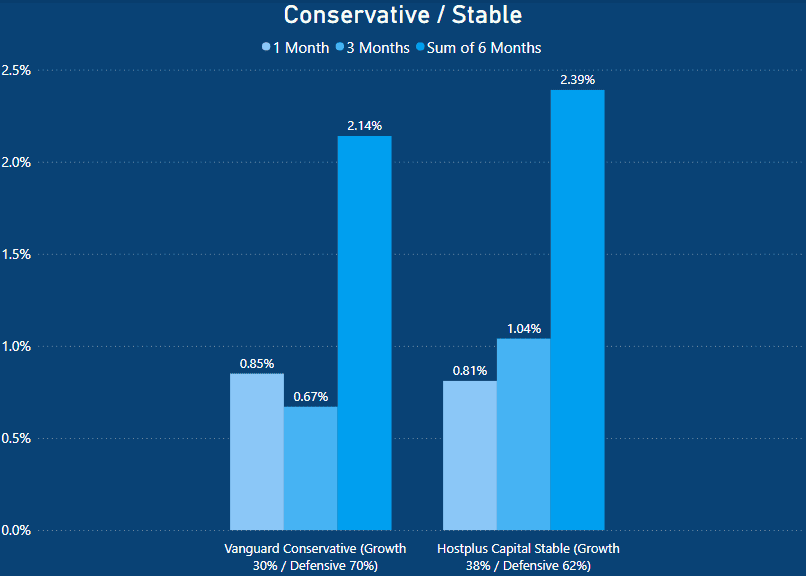

Vanguard Super Conservative vs Hostplus Capital Stable

Vanguard’s conservative option is split between 30% growth assets and 70% defensive assets. Whereas Hostplus Super capital stable is split 38% growth assets and 62% defensive assets.

When evaluating the performance of the two options, Vanguards conservative option had the better one month performance. Hostplus however, had the better performance over 3 and 6 months.

Hostplus capital stable returned 0.25% more over the 6 months than that of Vanguards conservative option.

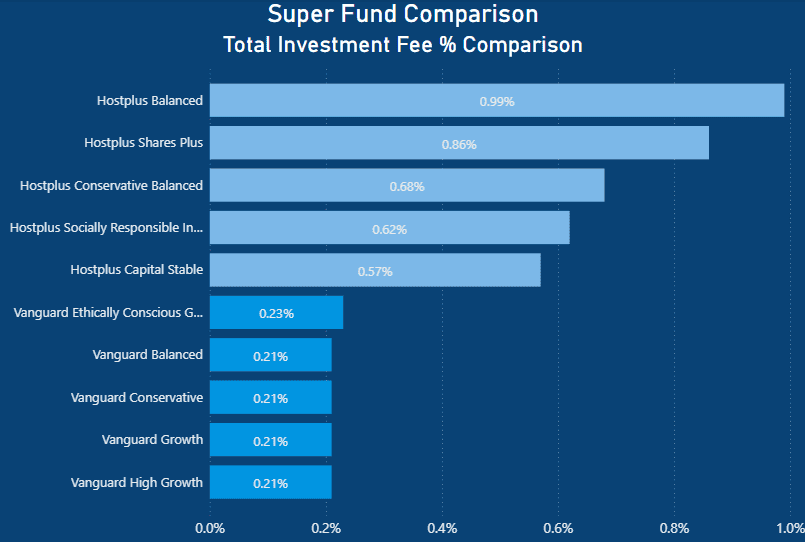

Hostplus vs Vanguard Super – Investment Fee Percentage Comparison

When comparing the investment fee percentages, Hostplus is clearly the more expensive option.

Total investment fees in this example include investment fees and costs, performance fees, and transaction costs. For a more in-depth look at fees and their explanation, you can read my in-depth Vanguard Super Review.

Vanguard distinguishes itself by promoting its low fee to approach to the super fund industry.

For instance, the High Growth option offered by Vanguard incurs a mere 0.21% fee, whereas Hostplus’ Share Plus option charges 0.86%.

Likewise, Hostplus’ priciest selection, the balanced option, carries a 0.99% fee. In contrast, Vanguard’s growth and balanced options are priced at only 0.21%.

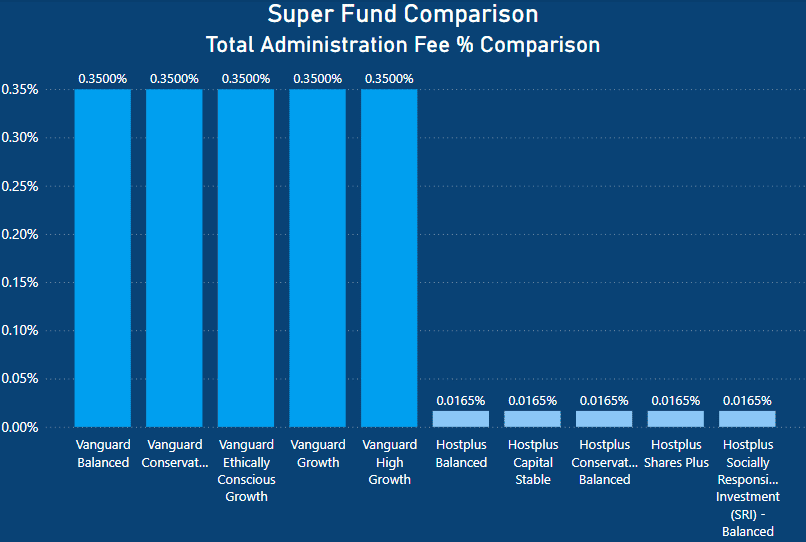

Hostplus vs Vanguard Super – Administration Fee Percentage Comparison

When comparing the administrative fees, Hostplus initially emerges as the clear winner with a minimal charge of 0.0165%. Conversely, Vanguard imposes a 0.35% fee for their administrative expenses.

However, it’s important to highlight that alongside this percentage-based administration fee, Hostplus enforces a fixed dollar cost.

This fixed cost amounts to $78 for all their options, equivalent to a weekly charge of $1.50. Vanguard does not charge any fixed dollar amounts at this time.

Furthermore, Hostplus made an extra deduction of $32.91 per member from the fund’s administrative reserve in the past fiscal year.

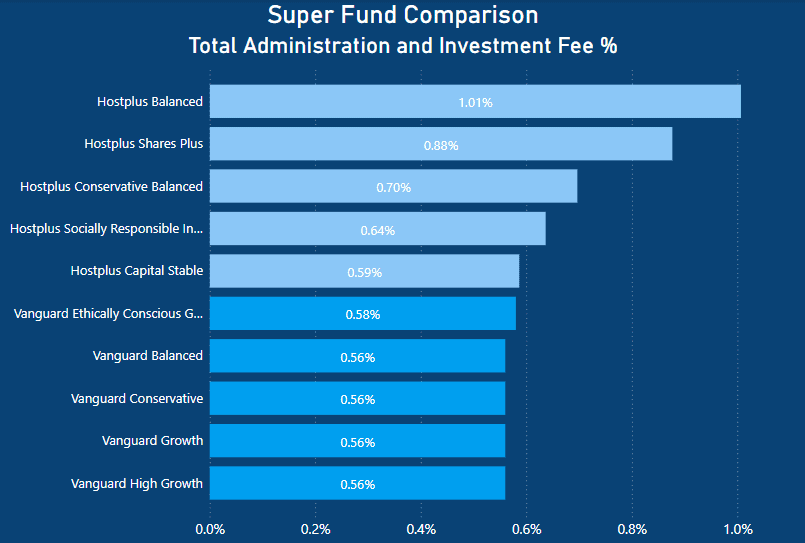

Vanguard Super vs Hostplus Super – Total Combined Fee Percentage Comparison

When comparing the total combined fees for the different options, Hostplus is the most expensive. For their balanced option, Hostplus levies a total combined fee of 1.01%, excluding the fixed dollar expenses mentioned earlier.

Vanguard, on the other hand, charges a fee of 0.56% for their equivalent growth and balanced options.

Vanguard’s highest-cost option is their ethically conscious choice, which carries a fee of 0.58%. In comparison, Hostplus’ equivalent option is slightly lower at 0.64%.

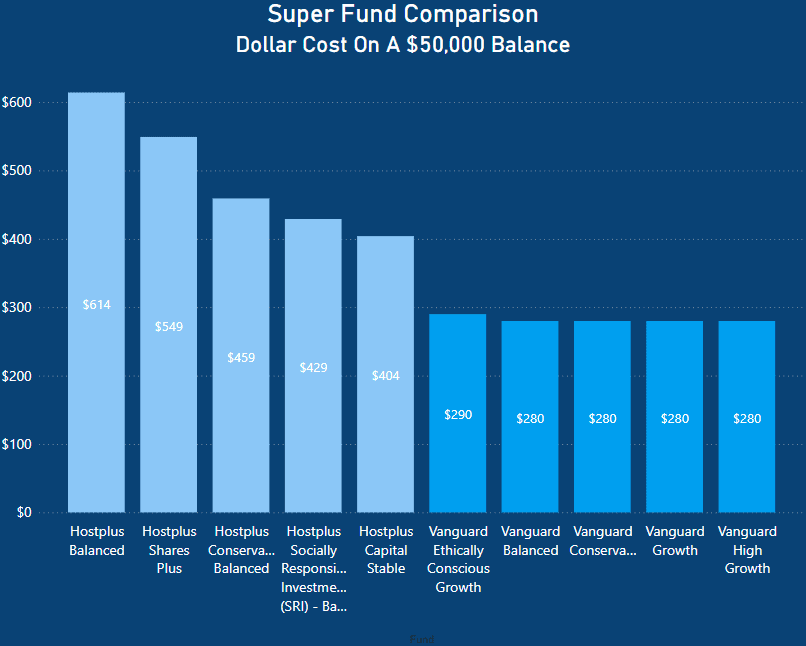

Vanguard Super vs Hostplus Super – Cost on a $50,000 Balance

When assessing the actual costs of each super fund option in real-world terms, Vanguard emerges as the most affordable choice.

Hostplus’ balanced option would amount to an annual cost of $614, while the equivalent Vanguard product costs $280.

Vanguard’s ethically conscious option represents its most expensive option at $290, whereas Hostplus’ capital stable option is its cheapest at $404.

Hostplus products incur greater costs due to several reasons, primarily their higher percentage-based fees. As Hostplus applies significantly higher percentage-based fees, the costs gap would only increase as the super balance grows.

The impact of percentage-based fees is more pronounced for individuals with larger, more substantial balances. The fixed dollar costs predominantly affect those with smaller balances but they do accumulate nonetheless.

Summary

When comparing super funds it is important to consider a variety of factors, not just their fees and general performance. As the saying goes, past performance is not a reliable indicator of future performance.

For this comparison only very short-term performances were assessed, owing to the fact Vanguard launched in October 2022.

A 6 month performance record is not enough data to draw truly meaningful comparisons on, especially if you are considering swapping funds.

That being said, it does highlight the significant disparity in fees. Vanguard has some really competitive low fees and will likely become a big market force in the future. When it comes to low fees other mega funds such as UniSuper are competitive in this space.

In my comprehensive UniSuper Review, I break down their fees and performance against the likes of Australia’s largest fund, Australian Super.

Lastly, on an interesting note, when I reviewed the Top 10 Super Funds In Australia, using The Australian Prudential Regulation Authority (APRA) data. I found that Hostplus had the best average 5 and 10 year performances across their whole portfolio options.

This article is for informational purposes only and does not constitute as an endorsement or recommendation to purchase any specific mentioned product. Past performance is not a reliable indicator of future performance.

- https://www.vanguard.com.au/media-centre/articles/vanguard-australia-announces-enhancements-to-its-retail-business

- https://hostplus.com.au/about-us

- https://hostplus.com.au/members/our-products-and-services/investment-options/your-investment-options/pre-mixed/socially-responsible-investment–sri—-balanced#accordion-82a44f6136-item-7fa65b7136