Hostplus vs Australian Super: Which Gets You A Better Retirement?

Last Updated on 27 January 2024 by Ryan Oldnall

Australian Super stands as Australia’s largest industry superannuation fund, boasting a membership of over 3 million individuals. It maintains offices not only in all major Australian cities but also in international locations such as London, Beijing, and New York [1].

In contrast, Hostplus Super is a firmly established superannuation provider, serving more than 1.77 million members and overseeing assets totaling $102.6 billion [2].

So let’s explore Hostplus vs Australian Super. Who has the better performance, fees and what is the cost on a $50,000 super balance?

Hostplus vs Australian Super Comparison Snapshot

Australian Super Performance vs Hostplus Performance

Australian Super and Hostplus have long standing track records, with both funds making their historical performance available.

Therefore we are easily able to perform a comparison of Hostplus vs Australian Super

The performance information was collected from the individual super funds’ websites and is current as of June 30, 2023.

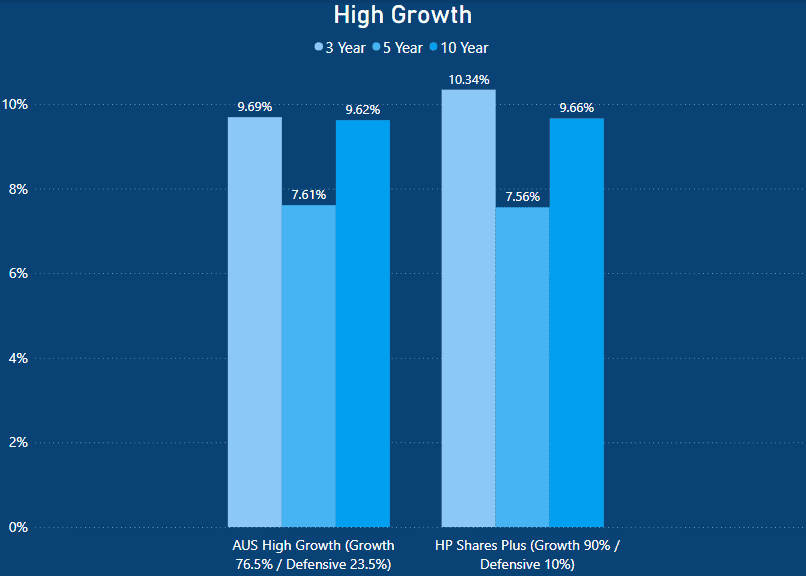

Australian Super High Growth vs Hostplus Shares Plus

Australian Super’s High Growth option is split between 76.5% growth assets and 23.5% defensive assets. Whereas Hostplus Shares Plus Investment is split 90% growth assets and 10% defensive assets.

When evaluating the short-term performance of the high growth options of Australian Super vs Hostplus. Hostplus had the stronger performance over 3 years with a return of 10.34%. This was 0.65% better than Australia Supers 9.69%

Over the medium term of 5 years, the performances were comparable with Australian Super returning 7.61% and Hostplus 7.56%.

Similarly, over 10 years, Australian Super returned 9.62% which was fractionally less than Hostplus’ 9.66%.

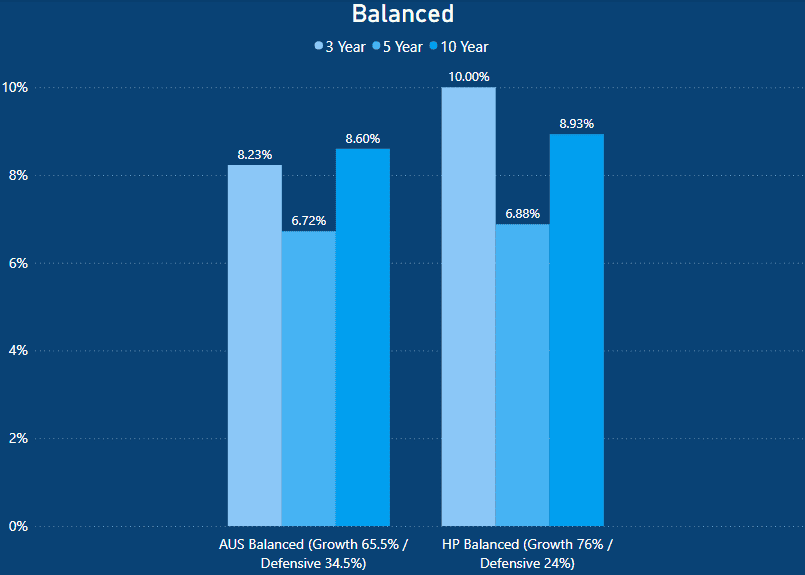

Australian Super vs Hostplus Balanced

Australian Super’s balanced option is split between 65.5% growth assets and 34.5% defensive assets. Whereas Hostplus Shares Plus Investment is split 76% growth assets and 24% defensive assets.

When comparing the short term performance of Hostplus and Australian Super, Hostplus’ 10.00% return is much higher than that of Australian Super. Over 3 years, Australian Super returned 8.23% which is 1.77% less than Hostplus.

However, over the medium term of 5 years, Australian Super bridges the gap to return 6.72%, with Hostplus returning 6.88%.

Again, Over the 10 years, Australian Super was outperformed by Hostplus. Australian Super’s growth performance was 8.60% with Hostplus returning 8.93%.

The difference in overall performance could possibly be attributed to the more defensive tilt of the Australian Super option.

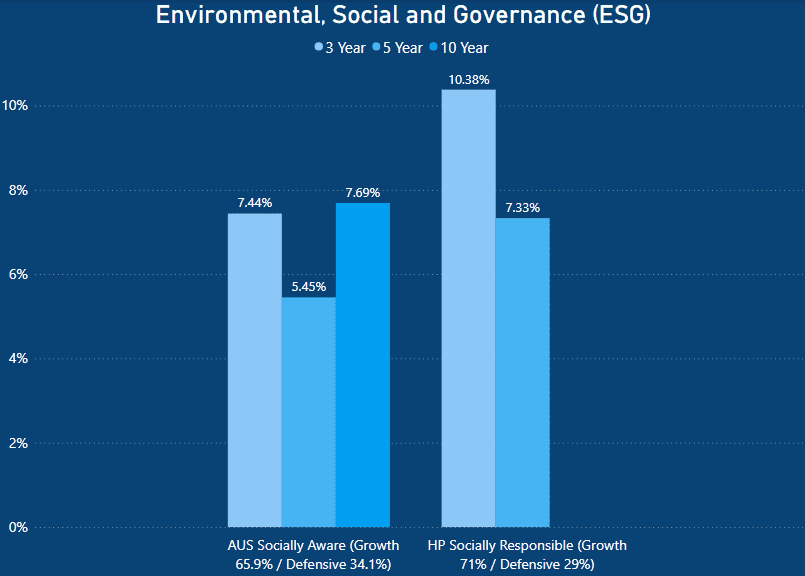

Hostplus Socially Responsible vs Australian Super Socially Aware

Australian Super’s High Growth option is split between 65.9% growth assets and 34.1% defensive assets. Whereas Hostplus Shares Plus Investment is split into 71% growth assets and 29% defensive assets.

Over 3 years, Hostplus has achieved remarkable outcomes, yielding an impressive return of 10.38%. This even surpasses the 10.34% return of the Hostplus Shares Plus (High Growth) option.

Conversely, Australian Super generated a return of 7.44% during the same period, lagging behind by 2.94%.

Extending to a 5 year time horizon, Hostplus once again exhibited superior performance with a return of 7.33%. In comparison, Australian Super’s performance was notably lower at 5.45%, trailing Hostplus by 1.88%.

Over a 10 year span, Australian Super achieved a return of 7.69% with their Socially Aware option, whereas Hostplus does not have a 10 year performance record.n

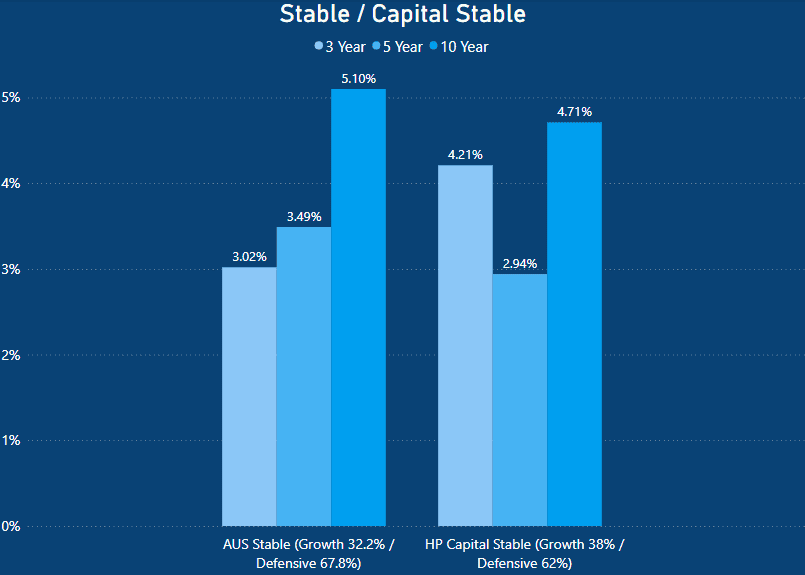

Hostplus vs Australian Super Stable/ Capital Stable

Australian Supers stable option is split between 32.2% growth assets and 67.8% defensive assets. Whereas Hostplus Super capital stable is split into 38% growth assets and 62% defensive assets.

When assessing the performance of these two options, Hostplus’ capital stable option outperformed in the 3 year timeframe. However, Australian Super demonstrated better performance over the 5 and 10-year periods.

Hostplus delivered a 4.21% return over a 3 year duration, which notably surpassed Australian Super’s 3.02% return.

Conversely, Australian Super’s performance yielded returns of 3.49% over 5 years and 5.10% over 10 years, outperforming Hostplus’ returns of 2.94% and 4.71% in the respective time frames.

Hostplus vs Australian Super – Investment Fee Percentage Comparison

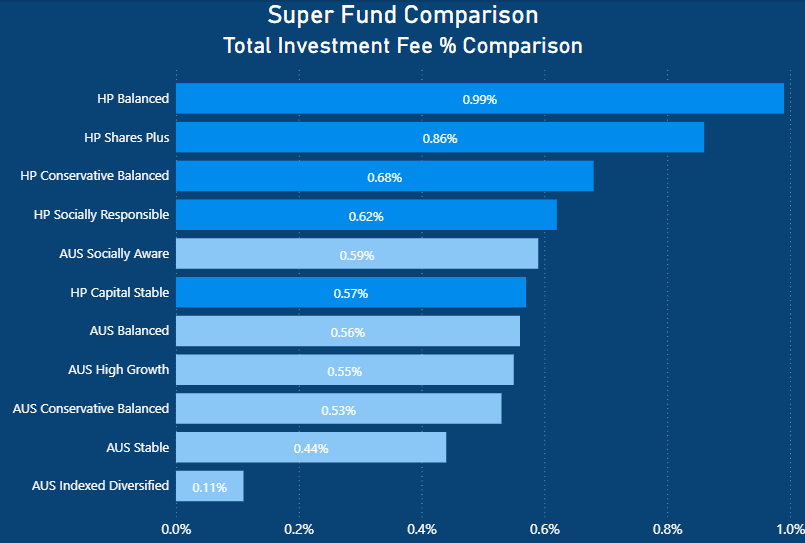

When comparing the investment fee percentages, Hostplus is clearly the more expensive option. Total investment fees in this example include investment fees and costs, performance fees, and transaction costs.

For a more in-depth look at fees and their explanation, you can read my in-depth Vanguard Super Review. In this review, I not only discuss Vanguard’s low fee options but go into greater detail on the overall fee breakdowns

Hostplus’ fees across the board are higher than Australian Super’s, with the exception of their capital stable option which is 0.02% less than Australian Super’s most expensive option.

When comparing the two high-growth options, Australian Super charges 0.55%, while the equivalent Hostplus option, their shares plus option, charges 0.86%.

Furthermore, Hostplus charges 0.99% on their balanced option, which is significantly more than Australian Super’s 0.56% fee for their balanced option.

Hostplus vs Australian Super – Administration Fee Percentage Comparison

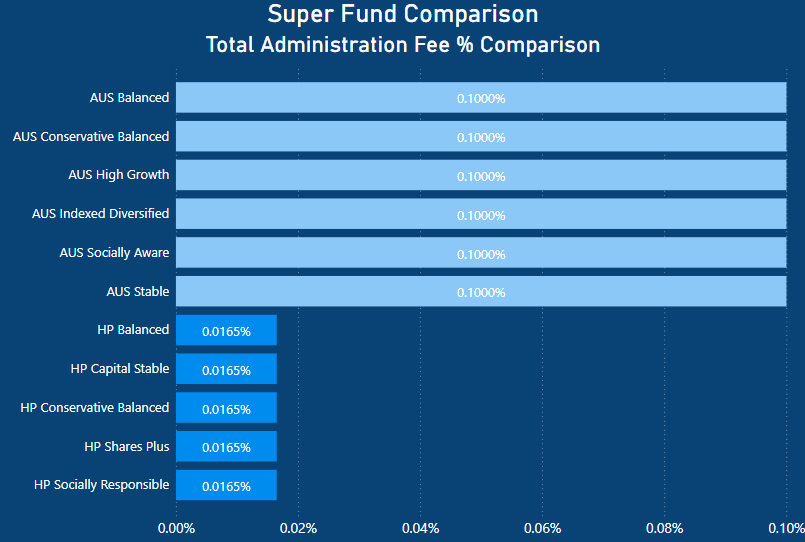

When comparing the administrative fees, Hostplus initially emerges as the clear winner with a minimal charge of 0.0165%. Conversely, AustralianSuper charges a 0.10% fee for their administrative expenses.

However, it’s important to note that in addition to these percentage-based administration fees, both Hostplus and Australian Super apply additional fixed dollar costs.

Australian Super charges a fixed dollar cost of $1 per week, equivalent to $52 annually. On the other hand, Hostplus charges $78 for all their options, which translates to a weekly fee of $1.50.

Furthermore, Hostplus made an extra deduction of $32.91 per member from the fund’s administrative reserve in the past financial year.

Australian Super vs Hostplus Super – Total Combined Fee Percentage Comparison

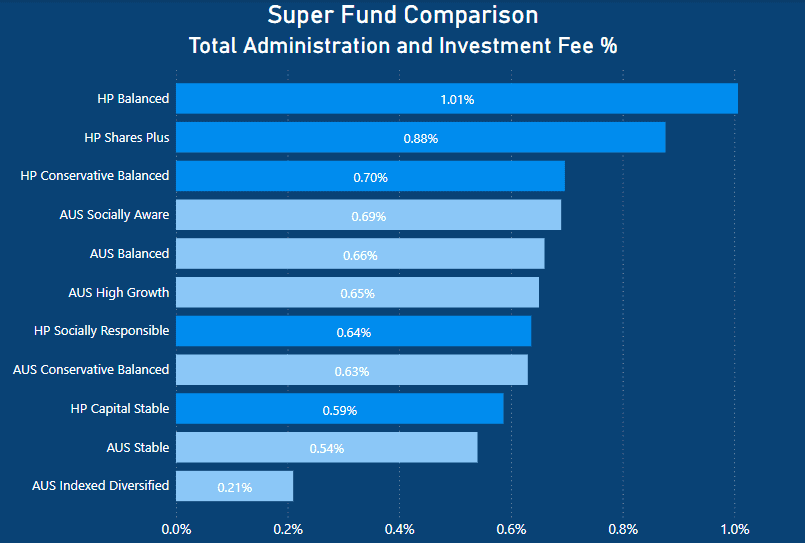

When evaluating the total combined fees across various options, it becomes evident that Hostplus stands out as the most expensive super fund. For their balanced option, Hostplus charges a total combined fee of 1.01%, exclusive of the fixed dollar expenses mentioned earlier.n

Conversely, Australian Super charges a fee of 0.66% for their equivalent balanced option. When examining the High Growth products, Australian Super applies a fee of 0.65%, while Hostplus’ Shares Plus option carries a fee of 0.88%.

Among Australian Super’s options, their socially aware option is the most expensive option with a fee of 0.69%. In contrast, Hostplus’ most affordable choice is their capital stable option at 0.59%.

For those seeking a genuinely low-cost alternative, Australian Super’s index diversified option offers a minimal fee of 0.21%.

Hostplus Super vs Australian Super – Cost on a $50,000 Balance

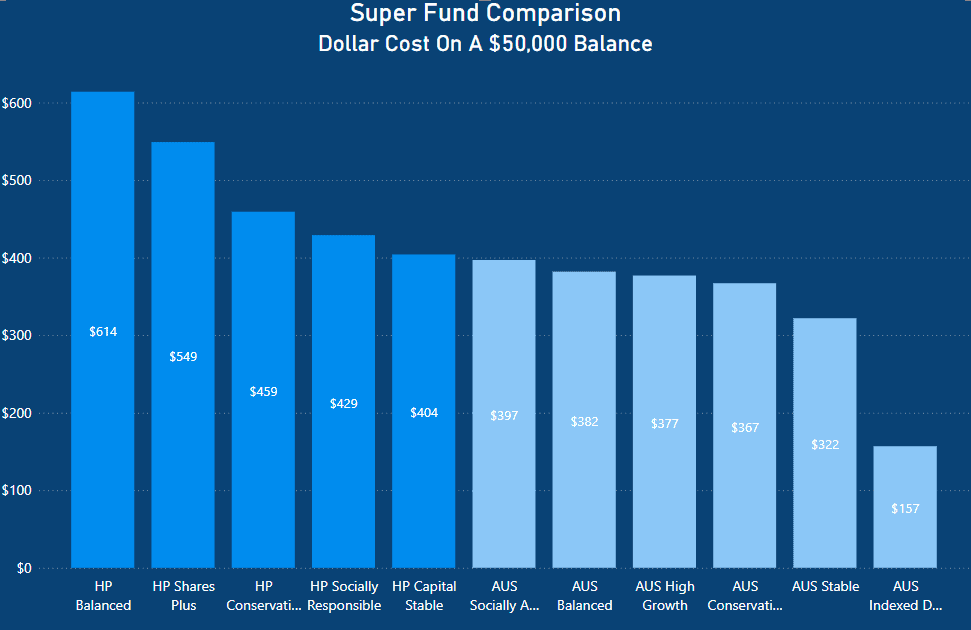

When evaluating the practical expenses associated with each super fund option, Australian Super emerges as the more cost-effective selection.

Hostplus’ balanced option would result in an annual cost of $614, whereas the comparable Australian Super alternative carries a cost of $377.

Among Australian Super’s options, the socially aware option represents the highest expense at $397, while Hostplus’ most budget-friendly choice is their capital stable option at $404.

The increased costs of Hostplus products stem from various factors, primarily their higher percentage-based fees. With Hostplus imposing notably higher percentage-based fees, the cost differential would only widen as the super balance grows.

The impact of percentage-based fees becomes particularly pronounced for individuals with larger account balances. Although the fixed dollar costs predominantly affect those with smaller balances, they do accumulate over time.

Summary – Which To Choose? Australian Super vs Hostplus Super

When comparing super funds, it’s essential to consider various factors beyond just fees and general performance. As the saying goes, past performance is not a reliable indicator of future performance.

Hostplus has achieved superior returns on some of their options compared to AustralianSuper over 10 years. Notably, Hostplus achieved this with their Shares Plus option (0.04%+) and Balanced option (0.33%+).

Nevertheless, this also emphasizes a notable contrast in fees. Australian Super offers lower, more budget-friendly fees, which are markedly more affordable when compared to Hostplus’ higher charges.

While Australian Super is categorized as a “lower fee” megafund, it’s important to note that it may not necessarily be the “lowest fee” super fund available. In the landscape of low-cost options, other megafunds like UniSuper also provide competition.

In my comprehensive UniSuper Review, I even provide an in-depth breakdown of their fees and performance relative to that of Australian Super.

Lastly, to round out this comparison, when I reviewed the Top 10 Super Funds In Australia, using The Australian Prudential Regulation Authority (APRA) data.

I found that Hostplus had the best average 5 and 10 year performances across their whole portfolio options. This means that across all of the super funds in the APRA data, Hostplus had the highest average performance.

Thus, the question remains for the average Australian – How important are fees? Hostplus has had some of the best returns in the past 5 and 10 years, but does their fee justify the additional performance returns?

This article is for informational purposes only and does not constitute as an endorsement or recommendation to purchase any specific mentioned product. Past performance is not a reliable indicator of future performance.

- https://www.australiansuper.com/campaigns/super-moments

- https://hostplus.com.au/about-us

- https://www.thinkingaheadinstitute.org/content/uploads/2022/09/PI-300-2022.pdf